Form 8-K SUPERNUS PHARMACEUTICALS For: Oct 10

Exhibit 2.1

EXECUTION COPY

AGREEMENT AND PLAN OF MERGER

by and among:

ADAMAS PHARMACEUTICALS, INC.,

SUPERNUS PHARMACEUTICALS, INC.,

and

SUPERNUS REEF, INC.

Dated as of October 10, 2021

___________________________

TABLE OF CONTENTS

| Page | ||

| Article 1 DEFINITIONS | 2 | |

| Section 1.1 | Definitions | 2 |

| Article 2 THE OFFER | 14 | |

| Section 2.1 | The Offer | 14 |

| Section 2.2 | Company Actions | 17 |

| Article 3 MERGER TRANSACTION | 18 | |

| Section 3.1 | Merger of Purchaser into the Company | 18 |

| Section 3.2 | Effect of the Merger | 18 |

| Section 3.3 | Closing; Effective Time | 19 |

| Section 3.4 | Certificate of Incorporation and Bylaws; Directors and Officers | 19 |

| Section 3.5 | Conversion of Shares | 19 |

| Section 3.6 | Surrender of Certificates; Stock Transfer Books | 20 |

| Section 3.7 | Dissenters’ Rights | 23 |

| Section 3.8 | Treatment of Company Options, Company RSU Awards and Company ESPP | 23 |

| Section 3.9 | Further Action | 25 |

| Article 4 REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 25 | |

| Section 4.1 | Due Organization; Subsidiaries, Etc. | 25 |

| Section 4.2 | Certificate of Incorporation and Bylaws | 26 |

| Section 4.3 | Authority; Binding Nature of Agreement | 26 |

| Section 4.4 | Capitalization, Etc. | 26 |

| Section 4.5 | Non-Contravention; Consents | 27 |

| Section 4.6 | SEC Filings; Financial Statements | 28 |

| Section 4.7 | Absence of Changes | 30 |

| Section 4.8 | Intellectual Property | 30 |

| Section 4.9 | Privacy and Security | 32 |

| Section 4.10 | Contracts | 33 |

| Section 4.11 | No Undisclosed Liabilities | 35 |

| Section 4.12 | Litigation | 35 |

-i-

TABLE OF CONTENTS

(continued)

| Page | ||

| Section 4.13 | Compliance with Laws | 35 |

| Section 4.14 | Regulatory Matters; Product Liability and Recalls | 36 |

| Section 4.15 | Certain Business Practices | 38 |

| Section 4.16 | Governmental Authorizations | 39 |

| Section 4.17 | Tax Matters | 39 |

| Section 4.18 | Employee Matters; Benefit Plans | 40 |

| Section 4.19 | Environmental Matters | 42 |

| Section 4.20 | Real Property | 42 |

| Section 4.21 | Title to Assets | 43 |

| Section 4.22 | Insurance | 43 |

| Section 4.23 | Section 203 of the DGCL | 43 |

| Section 4.24 | Merger Approval | 43 |

| Section 4.25 | Opinion of Financial Advisor | 43 |

| Section 4.26 | Brokers and Other Advisors | 44 |

| Article 5 REPRESENTATIONS AND WARRANTIES OF PARENT AND PURCHASER | 44 | |

| Section 5.1 | Due Organization | 44 |

| Section 5.2 | Purchaser | 44 |

| Section 5.3 | Authority; Binding Nature of Agreement | 44 |

| Section 5.4 | Non-Contravention; Consents | 44 |

| Section 5.5 | Disclosure | 45 |

| Section 5.6 | Litigation | 45 |

| Section 5.7 | Solvency | 45 |

| Section 5.8 | Ownership of Company Common Stock; Absence of Certain Arrangements | 46 |

| Section 5.9 | Brokers and Other Advisors | 46 |

| Section 5.10 | Sufficient Funds | 46 |

| Section 5.11 | Acknowledgement by Parent and Purchaser | 46 |

| Article 6 CERTAIN COVENANTS OF THE COMPANY | 47 | |

| Section 6.1 | Access and Investigation | 47 |

| Section 6.2 | Operation of the Business | 48 |

-ii-

TABLE OF CONTENTS

(continued)

| Page | ||

| Section 6.3 | No Solicitation | 51 |

| Article 7 ADDITIONAL COVENANTS OF THE PARTIES | 52 | |

| Section 7.1 | Company Board Recommendation | 52 |

| Section 7.2 | Filings, Consents and Approvals | 53 |

| Section 7.3 | Continuing Employee Benefits | 56 |

| Section 7.4 | Indemnification of Officers and Directors | 58 |

| Section 7.5 | Securityholder Litigation | 59 |

| Section 7.6 | Further Assurances | 60 |

| Section 7.7 | Public Announcements; Disclosure | 60 |

| Section 7.8 | Takeover Laws | 60 |

| Section 7.9 | Section 16 Matters | 60 |

| Section 7.10 | Rule 14d-10 Matters | 61 |

| Section 7.11 | Purchaser Stockholder Consent | 61 |

| Section 7.12 | Stock Exchange Delisting; Deregistration | 61 |

| Section 7.13 | Other Agreements and Understandings | 61 |

| Article 8 CONDITIONS PRECEDENT TO THE MERGER | 61 | |

| Section 8.1 | No Restraints | 61 |

| Section 8.2 | Consummation of Offer | 62 |

| Article 9 TERMINATION | 62 | |

| Section 9.1 | Termination | 62 |

| Section 9.2 | Effect of Termination | 63 |

| Section 9.3 | Expenses; Termination Fee | 64 |

| Article 10 MISCELLANEOUS PROVISIONS | 65 | |

| Section 10.1 | Amendments | 65 |

| Section 10.2 | Waiver | 65 |

| Section 10.3 | No Survival | 66 |

| Section 10.4 | Entire Agreement; Counterparts | 66 |

| Section 10.5 | Applicable Laws; Jurisdiction; Specific Performance; Remedies | 66 |

| Section 10.6 | Assignment | 67 |

| Section 10.7 | No Third Party Beneficiaries | 68 |

-iii-

TABLE OF CONTENTS

(continued)

| Page | ||

| Section 10.8 | Notices | 68 |

| Section 10.9 | Severability | 69 |

| Section 10.10 | Obligation of Parent | 69 |

| Section 10.11 | Transfer Taxes | 70 |

| Section 10.12 | Interpretations | 70 |

| Section 10.13 | Company Disclosure Schedule References | 71 |

| Exhibits | |

| Exhibit A | Surviving Corporation Certificate of Incorporation |

| Exhibit B | Surviving Corporation Bylaws |

| Annexes | |

| Annex I | Conditions to the Offer |

| Annex II | Form of Contingent Value Rights Agreement |

-iv-

AGREEMENT AND PLAN OF MERGER

This Agreement and Plan of Merger (this “Agreement”) is made and entered into as of October 10, 2021 (the “Agreement Date”), by and among Supernus Pharmaceuticals, Inc., a Delaware corporation (“Parent”), Supernus Reef, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Purchaser”), and Adamas Pharmaceuticals, Inc., a Delaware corporation (the “Company”). Certain capitalized terms used in this Agreement shall have the meanings ascribed to such terms in Article 1.

Recitals

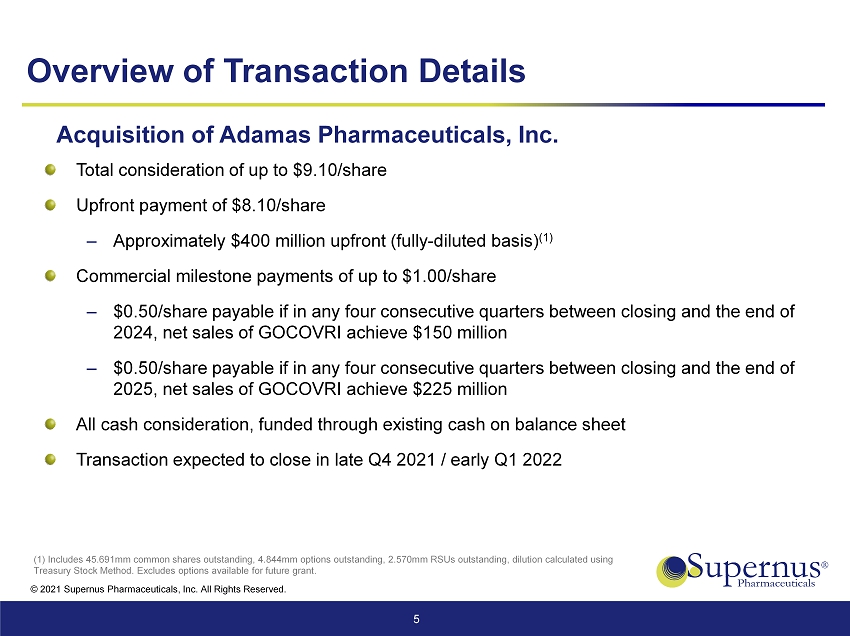

WHEREAS, Parent has agreed to cause Purchaser to commence a cash tender offer (as it may be amended from time to time as permitted under this Agreement, the “Offer”) to acquire all of the outstanding shares of Company Common Stock (the “Shares”) for (i) $8.10 per share in cash (the “Cash Amount”) plus (ii) two (2) contingent value right payments per Share (each, a “CVR”), which shall represent the right to receive the Milestone Payments (as such term is defined in the CVR Agreement) (the Cash Amount plus the CVRs, collectively, or any higher amount per share paid pursuant to the Offer, being the “Offer Price”), in cash, net of applicable withholding Taxes and without interest, on the terms and subject to the conditions set forth in this Agreement;

WHEREAS, as soon as practicable following the consummation of the Offer, Purchaser will be merged with and into the Company (the “Merger”), with the Company continuing as the surviving corporation in the Merger and as a wholly owned Subsidiary of Parent (the “Surviving Corporation”), on the terms and subject to the conditions set forth in this Agreement, whereby, (i) each issued and outstanding Share (other than the Excluded Shares and Dissenting Shares) shall be converted into the right to receive the Offer Price, in cash, net of applicable withholding Taxes and without interest, (ii) each Converted Share shall represent the right to receive the Merger Consideration, in cash, net of applicable withholding Taxes and without interest and (iii) the Company shall become a wholly owned Subsidiary of Parent as a result of the Merger.

WHEREAS, the board of directors of the Company (the “Company Board”) has (i) determined that this Agreement and the Transactions, including the Offer and the Merger, are fair to, and in the best interest of, the Company and its stockholders, (ii) approved the execution, delivery and performance by the Company of this Agreement and the consummation of the Transactions, including the Offer and the Merger, (iii) resolved that the Merger shall be effected under Section 251(h) of the DGCL and (iv) resolved to recommend that the stockholders of the Company tender their Shares to Purchaser pursuant to the Offer (the “Company Board Recommendation”).

WHEREAS, the board of directors of each of Parent and Purchaser have (i) determined that this Agreement and the Transactions are in the best interests of Parent and Purchaser, respectively, and (ii) approved the execution, delivery and performance of this Agreement and the consummation of the Transactions, including the Offer and the Merger.

WHEREAS, each of Parent, Purchaser and the Company hereby acknowledges and agrees that the Merger shall be effected under Section 251(h) of the DGCL and shall, subject to satisfaction of the conditions set forth in this Agreement, be consummated as soon as practicable following the Offer Acceptance Time.

NOW THEREFORE, in consideration of the foregoing and the mutual covenants and agreements herein contained, and intending to be legally bound hereby, Parent, Purchaser and the Company hereby agree as follows:

Article 1

DEFINITIONS

Section 1.1 Definitions. For purposes of this Agreement (including this Article 1):

“Acceptable Confidentiality Agreement” means any agreement with the Company that is either (a) in effect as of the execution and delivery of this Agreement or (b) executed, delivered and effective after the execution and delivery of this Agreement, in either case containing provisions that require any counterparty thereto (and any of its Affiliates and Representatives) that receive material non-public information of, or with respect to, the Company to keep such information confidential; provided, however, that, in the case of clause (b), (i) the provisions contained therein are no less favorable in the aggregate to the Company than the terms of the Non-Disclosure Agreement (it being agreed that such agreement need not contain any “standstill” or similar provisions that prohibit the making of any Acquisition Proposal) and (ii) such agreement does not contain any provision that prohibits the Company from satisfying its obligations hereunder.

“Acquisition Proposal” means any proposal or offer from any Person (other than Parent and its Affiliates) or “group”, within the meaning of Section 13(d) of the Exchange Act, relating to, in a single transaction or series of related transactions, any (a) acquisition or license, outside of the ordinary course of business, in respect of a material portion of the Company Products, (b) issuance or acquisition of 10% or more of the outstanding Shares, (c) recapitalization, tender offer or exchange offer that if consummated would result in any Person or group beneficially owning 10% or more of the outstanding Shares or (d) merger, consolidation, amalgamation, share exchange, business combination, recapitalization, liquidation, dissolution or similar transaction involving the Company that if consummated would result in any Person or group beneficially owning 10% or more of the outstanding Shares, in each case other than the Transactions.

“Affiliate” means, as to any Person, any other Person that, directly or indirectly, controls, or is controlled by, or is under common control with, such Person. For this purpose, “control” (including, with its correlative meanings, “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of management or policies of a Person, whether through the ownership of securities or partnership or other ownership interests, by contract or otherwise.

“Agreement” is defined in the Preamble to this Agreement.

“Agreement Date” is defined in the Preamble to this Agreement.

-2-

“Anti-Corruption Laws” mean the Foreign Corrupt Practices Act of 1977, the Anti-Kickback Act of 1986, the UK Bribery Act of 2012, and the Anti-Bribery Laws of the People’s Republic of China or any applicable Laws of similar effect.

“Antitrust Laws” mean the Sherman Act, the Clayton Act, the HSR Act, the Federal Trade Commission Act, state antitrust laws, and all other applicable Laws (including non-U.S. Laws) issued by a Governmental Body that are designed or intended to preserve or protect competition, prohibit and restrict agreements in restraint of trade or monopolization, attempted monopolization, restraints of trade and abuse of a dominant position, or to prevent acquisitions, mergers or other business combinations and similar transactions, the effect of which may be to lessen or impede competition or to tend to create or strengthen a dominant position or to create a monopoly.

“Balance Sheet” is defined in Section 4.21 of this Agreement.

“Book-Entry Shares” mean non-certificated Shares represented by book-entry.

“Business Day” means a day except a Saturday, a Sunday or other day on which banks in the City of New York are authorized or required by Laws to be closed.

“Cash Amount” is defined in the Recitals of this Agreement.

“Cause” is defined in Section 7.3(a) of this Agreement.

“Certificates” is defined in Section 3.6(b) of this Agreement.

“Certificated Shares” mean Shares evidenced by Certificates.

“Closing” is defined in Section 3.3(a) of this Agreement.

“Closing Date” is defined in Section 3.3(a) of this Agreement.

“Code” means the Internal Revenue Code of 1986.

“Company” is defined in the Preamble to this Agreement.

“Company Adverse Change Recommendation” is defined in Section 7.1(a) of this Agreement.

“Company Associate” means each officer or other employee, or individual who is an independent contractor, consultant or director, of or to the Company or any of its Subsidiaries.

“Company Board” is defined in the Recitals of this Agreement.

“Company Board Recommendation” is defined in the Recitals of this Agreement.

“Company Common Stock” means the common stock, $0.001 par value per share, of the Company.

-3-

“Company Contract” means any Contract to which the Company or any of its Subsidiaries is a party.

“Company Disclosure Documents” is defined in Section 4.6(g) of this Agreement.

“Company Disclosure Schedule” means the disclosure schedule that has been prepared by the Company in accordance with the requirements of this Agreement and that has been delivered by the Company to Parent on the Agreement Date.

“Company Employee Agreement” means each management, employment, severance, retention, transaction bonus, change in control, consulting, relocation, repatriation or expatriation agreement or other Contract between: (a) the Company or any of its Subsidiaries and (b) any Company Associate (other than any Company Associate that is part time or paid on an hourly basis), other than any such Contract that is terminable “at will” (or following a notice period imposed by applicable Laws) without any obligation on the part of the Company or any of its Subsidiaries to make any severance, termination, change in control or similar payment or to provide any benefit.

“Company Equity Plans” means the 2014 Equity Incentive Plan and the 2016 Inducement Plan.

“Company ESPP” means the 2014 Employee Stock Purchase Plan.

“Company IP” means all Intellectual Property Rights that are owned or purported to be owned by the Company or any of its Subsidiaries.

“Company Lease” means any Company Contract pursuant to which the Company or any of its Subsidiaries leases or subleases Leased Real Property from another Person.

“Company Option” means an option to purchase Shares granted by the Company pursuant to the Company Equity Plans.

“Company Product” means GOCOVRI® (amantadine) and OSMOLEX ER® (amantadine).

“Company Related Parties” is defined in Section 9.3(c) of this Agreement.

“Company RSU Award” means an award of restricted stock units granted by the Company pursuant to the Company Equity Plans.

“Company SEC Documents” is defined in Section 4.6(a) of this Agreement.

“Company Stock Awards” means all Company Options, all Company RSU Awards and all Shares of restricted Company Common Stock.

“Consent” means any approval, consent, ratification, permission, waiver or authorization (including any Governmental Authorization).

-4-

“Continuing Employee” means (a) each employee of the Company who is employed by the Company as of immediately prior to the Effective Time to whom the Surviving Corporation extends an offer of continued employment (including at-will employment but excluding employment for less than three (3) months following the Closing Date) with the Surviving Corporation which such employee accepts on or prior to the Closing Date and (b) each Transition Employee.

“Contract” means any written, oral or other agreement, contract, subcontract, lease, understanding, instrument, bond, debenture, note, option, warrant, warranty, purchase order, license, sublicense, insurance policy, benefit plan or legally binding commitment or undertaking of any nature (except, in each case, ordinary course of business purchase orders).

“Converted Shares” means the Shares converted pursuant to and in accordance with Section 3.5(a)(iii) of the Agreement.

“COVID-19” means the coronavirus pandemic known as COVID-19.

“COVID-19 Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut-down, closure, sequester, safety or other Law, directive, guidelines or recommendations promulgated by any Governmental Body, including the Centers for Disease Control and Prevention and the World Health Organization, or by any U.S. industry group, in each case, in connection with or in response to COVID-19.

“CVR” is defined in the Recitals of this Agreement.

“CVR Agreement” means the Contingent Value Right Agreement in the form attached hereto as Annex II to be entered into between Parent and a rights agent mutually agreeable to Parent and the Company (the “Rights Agent”), with such revisions thereto requested by such Rights Agent that are not, individually or in the aggregate, detrimental to any Person entitled to the receipt of CVRs in the Transactions.

“Depository Agent” is defined in Section 3.6(a) of this Agreement.

“Determination Notice” is defined in Section 7.1(b) of this Agreement.

“DGCL” means the Delaware General Corporation Law.

“Dissenting Shares” is defined in Section 3.7 of this Agreement.

“DOJ” means the U.S. Department of Justice.

“DTC” is defined in Section 3.6(h) of this Agreement.

“Effect” means any change, effect, circumstance, fact, event or occurrence.

“Effective Time” is defined in Section 3.3(b) of this Agreement.

-5-

“Employee Plan” means any salary, bonus, vacation, deferred compensation, incentive compensation, stock purchase, stock option, severance pay, termination pay, death and disability benefits, hospitalization, medical, life or other insurance, flexible benefits, supplemental unemployment benefits, profit-sharing, pension or retirement plan, policy, program, agreement or arrangement and each other employee benefit plan or arrangement sponsored, maintained, contributed to or required to be contributed to by the Company for the benefit of any current or former employee of the Company or with respect to which the Company has any liability but excluding regular wages and salary.

“Encumbrance” means any lien, pledge, hypothecation, charge, mortgage, security interest, encumbrance, claim, infringement, interference, option, right of first refusal, preemptive right, community property interest or other similar restriction (including any restriction on the voting of any security, any restriction on the transfer of any security or other asset, any restriction on the receipt of any income derived from any asset, any restriction on the use of any asset and any restriction on the possession, exercise or transfer of any other attribute of ownership of any asset).

“End Date” is defined in Section 9.1(b) of this Agreement.

“Entity” means any corporation (including any non-profit corporation), general partnership, limited partnership, limited liability partnership, joint venture, estate, trust, company (including any company limited by shares, limited liability company or joint stock company), firm, society or other enterprise, association, organization or entity.

“Environmental Law” means any federal, state, local or foreign Law relating to pollution or protection of human health, worker health or the environment (including ambient air, surface water, ground water, land surface or subsurface strata), including any law or regulation relating to emissions, discharges, releases or threatened releases of Hazardous Materials, or otherwise relating to the manufacture, processing, distribution, use, treatment, storage, disposal, transport or handling of Hazardous Materials.

“ERISA” means the Employee Retirement Income Security Act of 1974.

“Exchange Act” means the Securities Exchange Act of 1934.

“Excluded Shares” means the Shares to be cancelled pursuant to and in accordance with Section 3.5(a)(i) and Section 3.5(a)(ii) of this Agreement.

“Expiration Date” is defined in Section 2.1(c) of this Agreement.

“Extension Deadline” is defined in Section 2.1(c) of this Agreement.

“FDA” means the U.S. Food and Drug Administration.

“FTC” means the U.S. Federal Trade Commission.

“GAAP” is defined in Section 4.6(b) of this Agreement.

-6-

“Governmental Authorization” means any (a) permit, license, certificate, franchise, permission, variance, clearance, registration, qualification or authorization issued, granted, given or otherwise made available by or under the authority of any Governmental Body or pursuant to any Law or (b) right under any Contract with any Governmental Body.

“Governmental Body” means any: (a) nation, state, commonwealth, province, territory, county, municipality, district or other jurisdiction of any nature; (b) federal, state, local, municipal, foreign or other government; or (c) governmental or quasi-governmental authority of any nature including any governmental division, department, agency, commission, instrumentality, official, ministry, fund, foundation, center, organization, unit, body or Entity and any court, arbitrator or other tribunal.

“Hazardous Materials” mean any waste, material, or substance that is listed, regulated or defined under any Environmental Law and includes any pollutant, chemical substance, hazardous substance, hazardous waste, special waste, solid waste, asbestos, mold, radioactive material, polychlorinated biphenyls, petroleum or petroleum-derived substance or waste.

“HIPAA” means the Health Insurance Portability and Accountability Act of 1996.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

“Inbound License” is defined in Section 4.8(c) of this Agreement.

“Indebtedness” means (a) any indebtedness for borrowed money (including the issuance of any debt security) to any Person other than the Company or any of its Subsidiaries, (b) any obligations evidenced by notes, bonds, debentures or similar Contracts to any Person other than the Company or any of its Subsidiaries, (c) any obligations in respect of letters of credit and bankers’ acceptances (other than letters of credit used as security for leases), or (d) any guaranty of any such obligations described in clauses (a) through (c) of any Person other than the Company or any of its Subsidiaries (other than, in any case, accounts payable to trade creditors and accrued expenses, in each case, arising in the ordinary course of business and not evidenced by notes, bonds, debentures or similar Contracts).

“Indemnified Persons” is defined in Section 7.4(a) of this Agreement.

“Indemnifying Parties” is defined in Section 7.4(b) of this Agreement.

“Intellectual Property Rights” means and includes all past, present, and future rights of the following types, which may exist or be created under the laws of any jurisdiction in the world: (a) rights associated with works of authorship, including exclusive exploitation rights, copyrights, moral rights, software, databases, and mask works; (b) trademarks, service marks, trade dress, logos, trade names and other source identifiers, domain names and URLs and similar rights and any goodwill associated therewith; (c) rights associated with trade secrets, know how, inventions, invention disclosures, methods, processes, protocols, specifications, techniques and other forms of technology; (d) patents and industrial property rights; (e) other proprietary rights in intellectual property of every kind and nature; (f) rights of privacy and publicity; and (g) all registrations, renewals, extensions, combinations, statutory invention registrations, provisionals, continuations, continuations-in-part, divisions, or reissues of, and applications for, any of the rights referred to in clauses (a) through (f) (whether or not in tangible form and including all tangible embodiments of any of the foregoing, such as samples, studies and summaries), along with all rights to prosecute and perfect the same through administrative prosecution, registration, recordation or other administrative proceeding, and all causes of action and rights to sue or seek other remedies arising from or relating to the foregoing.

-7-

“IRS” means the U.S. Internal Revenue Service.

“Knowledge” with respect to an Entity means with respect to any matter in question the actual knowledge of, in the case of the Company, Neil McFarlane, Christopher Prentiss, Vijay Shreedhar and Jason Christiansen, after reasonable inquiry, and in the case of any other Entity, such Entity’s executive officers after reasonable inquiry. With respect to matters involving Intellectual Property Rights, “reasonable inquiry” does not require that any of such Entity’s executive officers or their direct reports conduct or have conducted or obtain or have obtained any freedom-to-operate opinions or similar opinions of counsel or any Registered IP clearance searches, and no knowledge of any third party Registered IP that would have been revealed by such inquiries, opinions or searches will be imputed to such executive officers or their direct reports.

“Law” means any federal, state, local, municipal, foreign or other law (including common law), statute, constitution, principle of common law, resolution, order, ordinance, code, edict, judgment, decree, rule, regulation, ruling or requirement issued, pronounced, enacted, adopted, promulgated, implemented or otherwise put into effect by or under the authority of any Governmental Body.

“Leased Real Property” is defined in Section 4.20 of this Agreement.

“Legal Proceeding” means any action, suit, charge, complaint, litigation, arbitration, proceeding (including any civil, criminal, administrative, investigative or appellate proceeding), hearing, inquiry, audit, examination or investigation commenced, brought, conducted or heard by or before, or otherwise involving, any court or other Governmental Body or any arbitrator or arbitration panel.

“Material Adverse Effect” means any Effect which, individually or in the aggregate, (A) has had, or would reasonably be expected to have, a material adverse effect on the business, assets, financial condition, results of operations or financial prospects of the Company and its Subsidiaries, taken as a whole, or (B) would prevent the Company from consummating the Transactions on or before the End Date; provided, that none of the following shall be deemed in and of themselves, either alone or in combination, to constitute, and none of the following shall be taken into account in determining whether there is, or would reasonably be expected to be, a Material Adverse Effect:

(i) any Effect generally affecting the U.S. or foreign economies, financial or securities markets, or political, legislative, or regulatory conditions, or the industries in which the Company and its Subsidiaries operate;

-8-

(ii) any Effect arising out of or otherwise relating to fluctuations in the value of any currency exchange, interest or inflation rates or tariffs;

(iii) any Effect arising out of or otherwise relating to any change (or proposed change) in, or any compliance with or action taken for the purpose of complying with, any Law or GAAP (or interpretations of any Law or GAAP);

(iv) any Effect arising out of or otherwise relating to any act of terrorism, cyberterrorism (whether or not or sponsored by a Governmental Body), outbreak of hostilities, acts of war, trade war, national or international calamity or any other similar event (or the escalation of any of the foregoing);

(v) any acts of god, natural disasters, force majeure events, weather or environmental events, health emergencies, pandemics (including COVID-19) or epidemics (or the escalation of any of the foregoing and any governmental or industry responses thereto), including any COVID-19 Measures;

(vi) any change in the market price or trading volume of the Company’s stock or change in the Company’s credit ratings;

(vii) the failure of the Company to meet internal or analysts’ expectations, projections, forecasts, guidance or estimates, including the results of operations of the Company and its Subsidiaries, taken as a whole;

(viii) any Effect or other matter resulting from the announcement of this Agreement and the Transactions, including any Transaction Legal Proceeding, any Effect related to the identity of Parent, Purchaser or any of their Affiliates or Representatives, or facts and circumstances relating thereto, or any loss or threatened loss of, or adverse change or threatened adverse change in, the relationship of the Company or any of its Subsidiaries with any of their current or prospective suppliers, customers, wholesalers, service providers, distributors, licensors, licensees, regulators, employees, creditors, stockholders or other third parties (other than for purposes of any representation or warranty contained in Section 4.5 (Non-Contravention) but subject to disclosures in Section 4.5 of the Company Disclosure Schedule);

(ix) any Effect arising out of or otherwise directly relating to (A) any action taken by the Company at the written direction or written approval of Parent or Purchaser, or (B) any action specifically required to be taken by the Company or the failure of the Company to take any action that the Company is specifically prohibited from taking by the terms of this Agreement (including due to Parent not granting a consent requested by the Company pursuant to this Agreement);

(x) any Effect arising out of or relating to Parent’s or Purchaser’s breach of this Agreement; and

(xi) any actions taken by Parent, any of its Affiliates (including Purchaser) or their respective Representatives;

-9-

provided, however, that in the cases of clauses (i) through (v) (other than COVID-19 Measures), such exclusion shall only be applicable to the extent such matter does not have a materially disproportionate Effect on the Company and its Subsidiaries, taken as a whole, relative to other companies in the industries in which the Company and its Subsidiaries operate that are of a similar size to the Company and its Subsidiaries, taken as a whole, in which case such Effect shall be taken into account only to the extent of such materially disproportionate Effect on the Company and its Subsidiaries, taken as a whole; provided, further, that in the cases of clauses (vi) and (vii), the underlying causes of any such Effect may be considered in determining whether a Material Adverse Effect occurred to the extent not otherwise excluded by another exception in this definition; and provided, further, that none of clauses (i) through (xi) are to be construed as including the commencement or pendency of any Legal Proceeding against the Company or any of its Subsidiaries (except for the specific Transaction Legal Proceeding exception in clause (viii)).

“Material Company IP” means Company IP that claims the composition of matter of, or the method of making or using, any Company Product for an approved indication.

“Material Contract” is defined in Section 4.10(a) of this Agreement.

“Merger” is defined in the Recitals of this Agreement.

“Merger Consideration” is defined in Section 3.5(a)(iii) of this Agreement.

“Minimum Condition” is defined in Annex I to this Agreement.

“Nasdaq” means the Nasdaq Global Market.

“Non-Continuing Employee” is defined in Section 7.3(a) of this Agreement.

“Non-Continuing Employee Severance Benefits” is defined in Section 7.3(a) of this Agreement.

“Non-Disclosure Agreement” is defined in Section 6.1 of this Agreement.

“Offer” is defined in the Recitals of this Agreement.

“Offer Acceptance Time” is defined in Section 7.1(b) of this Agreement.

“Offer Commencement Date” means the date on which Purchaser commences the Offer, within the meaning of Rule 14d-2 under the Exchange Act.

“Offer Conditions” is defined in Section 2.1(b) of this Agreement.

“Offer Documents” is defined in Section 2.1(e) of this Agreement.

“Offer Price” is defined in the Recitals of this Agreement.

“Offer to Purchase” is defined in Section 2.1(b) of this Agreement.

“Option Consideration” is defined in Section 3.8(a) of this Agreement.

-10-

“Order” means, with respect to any Person, any order, judgment, decision, decree, injunction, ruling, writ, assessment or other similar requirement issued, enacted, adopted, promulgated or applied by any Governmental Body of competent jurisdiction that is binding on or applicable to such Person or its property.

“Outbound License” is defined in Section 4.8(c) of this Agreement.

“Packaging Materials” means any information (including prescription information such as labeling and package inserts, indications and safety instructions), packaging (including any boxes or other containers) and similar materials in each case relating to the packaging of the Company Products and including any material that is printed and employed in the packaging of the Company Products.

“Parent” is defined in the Preamble to this Agreement.

“Parent Material Adverse Effect” means any Effect that would, individually or in the aggregate, prevent, materially delay or materially impair the ability of Parent or Purchaser to consummate the Transactions.

“Parent Related Parties” is defined in Section 9.3(b) of this Agreement.

“Parties” mean Parent, Purchaser and the Company.

“Paying Agent” is defined in Section 3.6(a) of this Agreement.

“Payment Fund” is defined in Section 3.6(a) of this Agreement.

“Permitted Encumbrance” means (a) any Encumbrance that arises out of Taxes either not delinquent or the validity of which is being contested in good faith by appropriate proceedings, (b) any Encumbrance representing the rights of customers, suppliers, service providers and subcontractors in the ordinary course of business under the terms of any Contracts to which the relevant party is a party or under general principles of commercial or government contract Law (including mechanics’, materialmen’s, carriers’, workmen’s, warehouseman’s, repairmen’s, landlords’ and similar liens granted or which arise in the ordinary course of business), (c) in the case of any Contract, Encumbrances that are restrictions against the transfer or assignment thereof that are included in the terms of such Contract or any license of Intellectual Property Rights, (d) any Encumbrances for which appropriate reserves have been established in the consolidated financial statements of the Company and its Subsidiaries, (e) any Inbound License and any Outbound License and (f) in the case of real property, Encumbrances that are easements, rights-of-way, encroachments, restrictions, conditions and other similar Encumbrances incurred or suffered in the ordinary course of business and which, individually or in the aggregate, do not and would not materially impair the use (or contemplated use), utility or value of the applicable real property or otherwise materially impair the present or contemplated business operations at such location, or zoning, entitlement, building and other land use regulations imposed by Governmental Bodies having jurisdiction over such real property or that are otherwise set forth on a title report.

“Person” means any individual, Entity or Governmental Body.

-11-

“Personal Data” mean (a) any information that identifies, or could reasonably be used to identify, any particular individual and (b) any other information, including genetic material, that is protected by Privacy Obligations.

“Pre-Closing Period” is defined in Section 6.1 of this Agreement.

“Privacy Obligations” means, as to any Person, all applicable Laws (including HIPAA), publicly-facing statements or privacy policies of such Person, self-regulatory bodies to which such Person submits, industry codes of conduct, or contractual and fiduciary obligations of such Person to third parties (including such Person’s employees), access, rectification, portability, deletion, restriction, automated decision making or objection of any Person regarding Personal Data and all other valid and lawful requests related to data subject rights, in each case, concerning the privacy, integrity, accuracy, protection, management, sharing, exchange or other Handling of Personal Data.

“Product Registrations” means, with respect to the Company Products anywhere in the world, (a) any approvals, clearances, registrations, licenses, biologics license applications, listings, permits, investigational new drug exemptions, INDs, new drug applications, ODDs, breakthrough therapy designations, fast track designations, clinical trial authorizations or marketing authorizations, including FDA drug listings, marketing authorization approvals and other national or regional marketing authorizations or permits and CE marks, together with any supplements or amendments thereto (collectively, “Registration Approvals”), whether pending or issued, to the Company or any of its Subsidiaries by the relevant Governmental Body solely related to the research, development, manufacture, importation, distribution, marketing or sale of the Company Products over which such Governmental Body has authority, (b) any rights that the Company or an Affiliate of the Company has in any Registration Approval under any agreement pursuant to which any such Registration Approval is held in the name of a third party, and (c) pricing and reimbursement approval (if applicable or available) and all national drug code numbers (if any) assigned to the Company Products.

“Promotional Materials” means, collectively, any materials, including any sales, promotional and marketing materials or aids, advertising and display materials (including journal and broadcast advertisements), websites and other social media and internet platforms, Company Product literature, stationary, training materials and similar materials (including leave behind items, reprints, direct mailings, internet postings and sites), in each case, in whatever medium (other than Packaging Materials) relating to the marketing, promotion and commercialization of the Company Products.

“Purchaser” is defined in the Preamble to this Agreement.

“Registered IP” means all Intellectual Property Rights that are registered or issued under the authority of any Governmental Body, including all patents, registered copyrights, registered mask works, and registered trademarks, service marks and trade dress, registered domain names and all applications for any of the foregoing.

“Release” means any presence, emission, spill, seepage, leak, escape, leaching, discharge, injection, pumping, pouring, emptying, dumping, disposal, migration, or release of Hazardous Materials from any source into or upon the environment, including the air, soil, improvements, surface water, groundwater, the sewer, septic system, storm drain, publicly owned treatment works, or waste treatment, storage, or disposal systems.

-12-

“Representatives” means, with respect to an Entity, its directors, officers, employees, attorneys, accountants, investment bankers, consultants, agents, financial advisors, other advisors and other representatives.

“RSU Consideration” is defined in Section 3.8(b) of this Agreement.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“Schedule 14D-9” is defined in Section 2.2(a) of this Agreement.

“Schedule TO” is defined in Section 2.1(e) of this Agreement.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933.

“Shares” is defined in the Recitals of this Agreement.

“Specified Agreement” is defined in Section 9.1(d)(i) of this Agreement.

“Stockholder List Date” is defined in Section 2.2(b) of this Agreement.

“Subsidiary” means, with respect to any Person, any Entity of which such Person directly or indirectly owns or purports to own, beneficially or of record, (a) an amount of voting securities or other interests in such Entity that is sufficient to enable such Person to elect at least a majority of the members of such Entity’s Board of Directors or equivalent governing body, or (b) at least 50% of the outstanding equity or financial interests of such Entity.

“Superior Offer” means a bona fide written Acquisition Proposal on terms that the Company Board (or a committee thereof) has determined in good faith, after consultation with its financial advisor and outside legal counsel, would be more favorable, from a financial point of view, to the stockholders of the Company (in their capacity as such) than the Transactions (taking into account any legal, regulatory, timing, financing and other aspects of such Acquisition Proposal (including the capability of such Acquisition Proposal being consummated) and any revisions to this Agreement made or proposed in writing by Parent prior to the time of such determination); provided, that for purposes of the definition of “Superior Offer”, the references to “a material portion” and “10% or more” in the definition of Acquisition Proposal shall be deemed to be references to “90% or more.”

“Surviving Corporation” is defined in the Recitals of this Agreement.

“Takeover Laws” means any “moratorium,” “control share acquisition,” “fair price,” “supermajority,” “affiliate transactions,” or “business combination statute or regulation” or other similar state anti-takeover Laws, but excluding any Antitrust Laws.

-13-

“Tax” means any tax of any kind whatsoever (including any income, franchise, capital gains, gross receipts, value-added, estimated, unemployment, excise, ad valorem, transfer, stamp, sales, use, property, business, withholding or payroll tax), including any interest, penalty or addition thereto, in each case imposed, assessed or collected by or under the authority of any Governmental Body.

“Tax Return” means any return (including any information return), report, statement, declaration, estimate, schedule, notice, notification, form, election, certificate or other document or information filed with or submitted to, or required to be filed with or submitted to, any Governmental Body in connection with the determination, assessment, collection or payment of any Tax.

“Termination Condition” is defined in Annex I to this Agreement.

“Termination Fee” is defined in Section 9.3(b) of this Agreement.

“Transactions” means (a) the execution and delivery of this Agreement and (b) all of the transactions contemplated by this Agreement and the CVR Agreement, including the Offer and the Merger.

“Transition Employee” means each employee of the Company who is employed by the Company as of immediately prior to the Effective Time to whom the Surviving Corporation extends an offer of short-term employment (or other similar short-term services arrangement) with the Surviving Corporation for a term of employment (or other service arrangement) with a duration of at least three (3) months following the Closing Date in connection with transition or other integration matters, which such employee accepts on or prior to the Closing Date.

“Transition Employee Severance Benefits” is defined in Section 7.3(a) of this Agreement.

“Trigger Event” is defined in Section 9.1(c) of this Agreement.

“Willful Breach” means a deliberate act or a deliberate failure to act (including a failure to cure) by the Company, Parent or Purchaser, as the case may be, which act or failure to act constitutes in and of itself a material breach of any agreement or covenant in this Agreement, regardless of whether breaching this Agreement was the object of the act or failure to act (it being agreed by the Parties that Purchaser’s failure to purchase all Shares validly tendered (and not validly withdrawn) when required to do so in accordance with the terms of this Agreement shall be deemed to be a “Willful Breach”).

Article 2

THE OFFER

Section 2.1 The Offer.

(a) Commencement of the Offer. Provided that this Agreement shall not have been terminated in accordance with Article 9, as promptly as practicable after the Agreement Date (but in no event more than ten (10) Business Days after the Agreement Date), Purchaser shall (and Parent shall cause Purchaser to) commence (within the meaning of Rule 14d-2 under the Exchange Act) the Offer.

-14-

(b) Terms and Conditions of the Offer. The obligations of Purchaser to, and of Parent to cause Purchaser to, accept for payment, and pay for, any Shares tendered pursuant to the Offer are subject to the terms and conditions of this Agreement, including the prior satisfaction of the Minimum Condition and the satisfaction or waiver of the other conditions set forth in Annex I (collectively, the “Offer Conditions”). The Offer shall be made by means of an offer to purchase (the “Offer to Purchase”) that contains the terms set forth in this Agreement, the Minimum Condition and the other Offer Conditions. Purchaser expressly reserves the right to (i) increase the Offer Price, (ii) waive any Offer Condition and (iii) make any other changes in the terms and conditions of the Offer not inconsistent with the terms of this Agreement; provided, however, that unless otherwise provided by this Agreement, without the prior written consent of the Company, Purchaser shall not (A) decrease the Offer Price, (B) change the form of consideration payable in the Offer, (C) decrease the maximum number of Shares sought to be purchased in the Offer, (D) impose conditions or requirements to the Offer in addition to the Offer Conditions, (E) amend or modify any of the Offer Conditions in a manner that adversely affects any holder of Shares or that could, individually or in the aggregate, reasonably be expected to prevent or delay the consummation of the Offer or prevent, delay or impair the ability of Parent or Purchaser to consummate the Offer, the Merger or the other Transactions, (F) amend, modify, change or waive the Minimum Condition, the Termination Condition or the condition set forth in clause (g) of Annex I, (G) terminate the Offer or accelerate, extend or otherwise change the Expiration, except as permitted under Section 2.1(c) or Section 2.1(d), (H) provide any “subsequent offering period” within the meaning of Rule 14d-11 promulgated under the Exchange Act or (I) amend or modify the terms of the CVRs or the CVR Agreement (other than in accordance with the definition thereof).

(c) Expiration and Extension of the Offer. The Offer shall initially be scheduled to expire at one (1) minute following 11:59 p.m., Eastern Time, on the date that is the twentieth (20th) Business Day following the Offer Commencement Date, determined as set forth in Rule 14d-1(g)(3) and Rule 14e-1(a) under the Exchange Act, unless otherwise agreed to in writing by Parent and the Company (such date or such subsequent date to which the expiration of the Offer is extended in accordance with the terms of this Agreement, the “Expiration Date”). Subject to the Parties’ respective termination rights under Article 9: (i) if, as of the scheduled Expiration Date, any Offer Condition is not satisfied and has not been waived, Purchaser may, in its discretion (and without the consent of the Company or any other Person), extend the Offer on one or more occasions, for an additional period of up to ten (10) Business Days per extension, to permit such Offer Condition to be satisfied; (ii) Purchaser shall (and Parent shall cause Purchaser to) extend the Offer from time to time for (A) any period required by any Law, any interpretation or position of the SEC, the staff thereof or Nasdaq applicable to the Offer and (B) periods of up to ten (10) Business Days per extension, until any waiting period (and any extension thereof) applicable to the consummation of the Offer under the HSR Act shall have expired or been terminated; and (iii) if, as of the scheduled Expiration Date, each Offer Condition (other than the Minimum Condition and other than any such conditions that by their nature are to be satisfied at the expiration of the Offer) has been satisfied or waived and the Minimum Condition has not been satisfied, at the request of the Company, Purchaser shall (and Parent shall cause Purchaser to) extend the Offer for an additional ten (10) Business Day period to permit such the Minimum Condition to be satisfied; provided, however, in no event shall Purchaser or Parent be required to (and Parent shall not be required to cause Purchaser to) extend the expiration of the Offer pursuant to this clause (iii) for more than twenty (20) Business Days in the aggregate; provided, further, in no event shall Purchaser (1) be required to extend the Offer beyond the earlier to occur of: (x) the valid termination of this Agreement in compliance with Article 9 and (y) the first (1st) Business Day immediately following the End Date (the earlier of clauses (x) and (y), the “Extension Deadline”) or (2) be permitted to extend the Offer beyond the Extension Deadline without the prior written consent of the Company. Purchaser agrees that it shall not, and Parent shall not permit or authorize Purchaser to, terminate or withdraw the Offer prior to any scheduled Expiration Date without the prior written consent of the Company except in the event that this Agreement is terminated in accordance with Article 9.

-15-

(d) Termination of Offer. In the event that this Agreement is terminated pursuant to Section 9.1, Purchaser shall (and Parent shall cause Purchaser to) promptly (and, in any event, within twenty-four (24) hours of such termination), irrevocably and unconditionally terminate the Offer and shall not acquire any Shares pursuant to the Offer. If the Offer is terminated or withdrawn by Purchaser, Purchaser shall (and Parent shall cause Purchaser to) promptly return, and shall cause any depository acting on behalf of Purchaser to return, in accordance with applicable Laws, all tendered Shares to the registered holders thereof.

(e) Offer Documents. As promptly as practicable on the date of commencement (within the meaning of Rule 14d-2 under the Exchange Act) of the Offer, Parent and Purchaser shall (i) file with the SEC a tender offer statement on Schedule TO with respect to the Offer (together with all amendments and supplements thereto and including the exhibits thereto, the “Schedule TO”) that will contain as an exhibit or incorporate by reference the Offer to Purchase, the form of the related letter of transmittal and other customary ancillary documents in each case related to the Offer and (ii) cause the Offer to Purchase and related documents to be disseminated to the holders of Shares. Each of Parent and Purchaser agrees to cause the Schedule TO and all exhibits (including the Offer to Purchase), amendments or supplements thereto (collectively, the “Offer Documents”) filed by either Parent or Purchaser with the SEC to comply in all material respects with the Exchange Act and other applicable Laws, and to not contain any untrue statement of a material fact or omission of a material fact necessary in order to make the statements made therein, in light of the circumstances under which they are made, not misleading. The Company shall promptly furnish or otherwise make available to Parent and Purchaser or Parent’s legal counsel all information concerning the Company and the Company’s stockholders that may be required in connection with any action contemplated by this Section 2.1(e) so as to enable each of Parent and Purchaser to comply with its obligations hereunder. Each of Parent, Purchaser and the Company agrees to promptly correct any information provided by it for use in the Offer Documents if and to the extent that such information shall have become false or misleading in any material respect, and Parent further agrees to take all steps necessary to cause the Offer Documents as so corrected to be filed with the SEC and to be disseminated to the holders of Shares, in each case as and to the extent required by applicable federal securities Laws. The Company and its counsel shall be given reasonable opportunity to review and comment on the Offer Documents prior to the filing thereof with the SEC. Parent and Purchaser agree to provide the Company and its counsel with prompt notice of any comments (whether written or oral) that Parent, Purchaser or their counsel may receive from the SEC or its staff with respect to the Offer Documents (which notice shall include a copy of any written comments) and Parent and Purchaser shall keep the Company and its counsel reasonably informed as to their proposed response to any such comments of the SEC or its staff. Each of Parent and Purchaser shall respond promptly to any comments of the SEC or its staff with respect to the Offer Documents or the Offer.

-16-

(f) Acceptance; Payment Funds. On the terms specified herein and subject only to the satisfaction or waiver (to the extent waivable by Parent or Purchaser) of the Offer Conditions, Purchaser shall, and Parent shall cause Purchaser to, irrevocably accept for payment at the Offer Acceptance Time and pay for, all of the Shares validly tendered (and not validly withdrawn) pursuant to the Offer as promptly as practicable after the Offer Acceptance Time. Without limiting the generality of Section 10.10, Parent shall cause to be provided to Purchaser all of the funds necessary to purchase any Shares that Purchaser becomes obligated to purchase pursuant to the Offer, and shall cause Purchaser to perform, on a timely basis, all of Purchaser’s obligations under this Agreement. Parent and Purchaser shall, and each of Parent and Purchaser shall ensure that all of their respective Affiliates shall, tender any Shares held by them into the Offer.

(g) Adjustments. If, between the Agreement Date and the Offer Acceptance Time, the outstanding Shares are changed into a different number or class of shares by reason of any stock split, division or subdivision of shares, stock dividend, reverse stock split, consolidation of shares, reclassification, recapitalization or other similar transaction, then the Offer Price shall be appropriately adjusted.

(h) CVR Agreement. At or prior to the Offer Acceptance Time, Parent shall duly authorize, execute and deliver, and shall ensure that the Rights Agent duly authorizes, executes and delivers, the CVR Agreement.

Section 2.2 Company Actions.

(a) Schedule 14D-9. On the date that the Schedule TO is filed with the SEC, the Company shall file with the SEC and disseminate to the holders of Shares, in each case as and to the extent required by applicable federal securities Laws, a Tender Offer Solicitation/Recommendation Statement on Schedule 14D-9 (together with any exhibits, amendments or supplements thereto, the “Schedule 14D-9”) that, subject to Section 7.1(b), shall reflect the Company Board Recommendation and include the notice and other information required by Section 262(d)(2) of the DGCL. The Company shall set the record date for the Company’s stockholders to receive the notice of appraisal rights as the same date as the Stockholder List Date and shall disseminate the Schedule 14d-9 including such notice of appraisal rights to the Company’s stockholders to the extent required by Section 262(d) of the DGCL. The Company agrees that it shall cause the Schedule 14D-9 to comply in all material respects with the Exchange Act and other applicable Laws and to not contain any untrue statement of a material fact or omission of a material fact necessary in order to make the statements made therein, in light of the circumstances under which they are made, not misleading. Parent and Purchaser shall promptly furnish or otherwise make available to the Company or its legal counsel all information concerning Parent and Purchaser and their stockholders that may be required in connection with any action contemplated by this Section 2.2(a) so as to enable the Company to comply with its obligations hereunder. Each of Parent, Purchaser and the Company agrees to promptly correct any information provided by it for use in the Schedule 14D-9 if and to the extent that such information shall have become false or misleading in any material respect, and the Company further agrees to take all steps necessary to cause the Schedule 14D-9 as so corrected to be filed with the SEC and to be disseminated to the holders of Shares, in each case as and to the extent required by applicable federal securities Laws. Parent and its counsel shall be given reasonable opportunity to review and comment on the Schedule 14D-9 prior to the filing thereof with the SEC. The Company agrees to provide Parent and its counsel with prompt notice of any comments (whether written or oral) that the Company or its counsel may receive from the SEC or its staff with respect to the Schedule 14D-9 (which notice shall include a copy of any written comments) and the Company shall provide Parent and its counsel a reasonable opportunity to participate in the formulation of any response to any such comments of the SEC or its staff, including the opportunity to participate in any discussions with the SEC or its staff concerning such comments. The Company shall respond promptly to any comments of the SEC or its staff with respect to the Schedule 14D-9. Notwithstanding anything to the contrary in this Agreement, the obligations of the parties in this Section 2.2(a) shall not apply if the Company Board effects a Company Adverse Change Recommendation or has formally determined to do so.

-17-

(b) Stockholder Lists. The Company shall promptly (and in no event later than one (1) Business Day before the date the Offer Documents are first disseminated) furnish Parent with, or shall cause to be promptly furnished to Parent, a list of its stockholders, mailing labels and any available listing or computer file containing the names and addresses of all record holders of Shares and lists of securities positions of Shares held in stock depositories, in each case accurate and complete as of the most recent practicable date (the date of the list used to determine the Persons to whom the Offer Documents and the Schedule 14D-9 are first disseminated, the “Stockholder List Date”), and shall provide to Parent such additional information (including updated lists of stockholders, mailing labels and lists of securities positions) and such other assistance as Parent may reasonably request in connection with the Offer. Parent and Purchaser and their Representatives shall hold in confidence the information contained in any such labels, lists and files, shall use such information only in connection with the Offer and the Merger and, if this Agreement shall be terminated, shall promptly deliver, and shall use their reasonable best efforts to cause their Representatives to deliver, to the Company (or destroy) all copies and any extracts or summaries from such information then in their possession or control, and, if requested by the Company, promptly certify to the Company in writing that all such material has been returned or destroyed.

Article 3

MERGER TRANSACTION

Section 3.1 Merger of Purchaser into the Company. Upon the terms and subject to the conditions set forth in this Agreement and in accordance with the Section 251(h) of the DGCL, at the Effective Time, the Company and Parent shall consummate the Merger, whereby Purchaser shall be merged with and into the Company, the separate existence of Purchaser shall cease and the Company will continue as the Surviving Corporation.

Section 3.2 Effect of the Merger. The Merger shall have the effects set forth in this Agreement and in the applicable provisions of the DGCL. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all of the property, rights, privileges, powers and franchises of the Company and Purchaser shall vest in the Surviving Corporation, and all debts, liabilities and duties of the Company and Purchaser shall become the debts, liabilities and duties of the Surviving Corporation.

-18-

Section 3.3 Closing; Effective Time.

(a) Unless this Agreement shall have been terminated pursuant to Article 9, and unless otherwise mutually agreed in writing between the Company, Parent and Purchaser, the consummation of the Merger (the “Closing”) shall take place remotely by electronic exchange of documents, as soon as practicable following (but in any event on the same date as) the Offer Acceptance Time except if, subject to Section 2.1(b), the condition set forth in Section 8.1 shall not be satisfied or waived by such date, in which case on no later than the first (1st) Business Day on which the condition set forth in Section 8.1 is satisfied or waived. The date on which the Closing occurs is referred to in this Agreement as the “Closing Date.”

(b) Subject to the provisions of this Agreement, as soon as practicable on the Closing Date, the Company and Purchaser shall file or cause to be filed a certificate of merger with the Secretary of State of the State of Delaware with respect to the Merger, in such form as required by, and executed and acknowledged in accordance with, the applicable provisions of the DGCL. The Merger shall become effective upon the date and time of the filing of such certificate of merger with the Secretary of State of the State of Delaware or such later date and time as is agreed upon in writing by the Parties and specified in the certificate of merger (such date and time, the “Effective Time”).

Section 3.4 Certificate of Incorporation and Bylaws; Directors and Officers. At the Effective Time:

(a) the certificate of incorporation of the Surviving Corporation shall be amended and restated as of the Effective Time to conform to Exhibit A;

(b) the bylaws of the Surviving Corporation shall be amended and restated as of the Effective Time to conform to Exhibit B;

(c) the directors of the Surviving Corporation shall be the respective individuals who served as the directors of Purchaser as of immediately prior to the Effective Time, until their respective successors are duly elected and qualified, or their earlier death, resignation or removal; and

(d) the officers of the Surviving Corporation shall be the respective individuals who served as the officers of Purchaser as of immediately prior to the Effective Time, until their respective successors are duly appointed and qualified, or their earlier death, resignation or removal.

Section 3.5 Conversion of Shares.

(a) At the Effective Time, by virtue of the Merger and without any further action on the part of Parent, Purchaser, the Company or any other stockholder of the Company:

-19-

(i) any Shares then held by the Company or any of its Subsidiaries (including Shares held in the Company’s treasury) shall automatically be canceled and retired and shall cease to exist, and no consideration shall be delivered in exchange therefor;

(ii) any Shares then held by Parent, Purchaser or any other direct or indirect wholly owned Subsidiary of Parent shall automatically be canceled and retired and shall cease to exist, and no consideration shall be delivered in exchange therefor;

(iii) except for (A) the Excluded Shares and (B) Dissenting Shares, each Share then issued and outstanding shall be converted into the right to receive the Offer Price in cash, without interest (the “Merger Consideration”), subject to any withholding of Taxes required by applicable Laws in accordance with Section 3.6(e); and

(iv) each share of the common stock, $0.01 par value per share, of Purchaser then outstanding shall be converted into one (1) share of common stock of the Surviving Corporation.

(b) If, between the Agreement Date and the Effective Time, the outstanding Shares are changed into a different number or class of shares by reason of any stock split, division or subdivision of shares, stock dividend, reverse stock split, consolidation of shares, reclassification, recapitalization or other similar transaction, then the Merger Consideration shall be appropriately adjusted.

Section 3.6 Surrender of Certificates; Stock Transfer Books.

(a) Prior to the Offer Acceptance Time, Parent shall designate a bank or trust company reasonably acceptable to the Company to act as agent (the “Depository Agent”), for the holders of Shares to receive the funds to which such holders shall become entitled pursuant to Section 2.1(b) and to act as agent (the “Paying Agent”) for the holders of Shares to receive the funds to which such holders shall become entitled pursuant to Section 3.5(a)(iii). The Paying Agent Agreement pursuant to which Parent shall appoint the Paying Agent shall be in form and substance reasonably acceptable to the Company. Immediately prior to the Offer Acceptance Time, Parent shall deposit, or shall cause to be deposited, with the Depository Agent cash sufficient to make payment of the cash consideration payable pursuant to Section 2.1(b) and with the Paying Agent cash sufficient to make payment of the cash consideration payable pursuant to Section 3.5 (such deposits with the Depository Agent and with the Paying Agent, collectively, the “Payment Fund”). For the avoidance of doubt, Parent shall not be required to deposit any funds related to any CVR with the Rights Agent unless and until such deposit is required pursuant to the terms of the CVR Agreement. The Payment Fund shall not be used for any purpose other than to pay the aggregate Offer Price in the Offer and the aggregate Merger Consideration in the Merger; provided, however, the Payment Fund may be invested by the Paying Agent as directed by the Surviving Corporation; provided, further, that such investments shall be (1) in obligations of or guaranteed by the United States of America in commercial paper obligations rated A-1 or P-1 or better by Moody’s Investors Service, Inc. or Standard & Poor’s Corporation, respectively, (2) in certificates of deposit, bank repurchase agreements or banker’s acceptances of commercial banks with capital exceeding $1 billion, or (3) in money market funds having a rating in the highest investment category granted by a recognized credit rating agency at the time of acquisition or a combination of the foregoing and, in any such case, (i) no such investment will relieve Parent, Purchaser, or the Paying Agent from making the payments required by this Article 3 and (ii) no such investment will have maturities that could prevent or delay payments to be made pursuant to this Agreement.

-20-

(b) Promptly after the Effective Time (but in no event later than three (3) Business Days thereafter), the Surviving Corporation shall cause to be mailed to each Person who was, at the Effective Time, a holder of record of Shares entitled to receive the Merger Consideration pursuant to Section 3.5(a)(iii), (1) in the case of holders of record of Certificated Shares, a form of letter of transmittal in reasonable and customary form (which shall specify that delivery shall be effected, and risk of loss and title to the certificates evidencing such Shares (the “Certificates”) shall pass, only upon proper delivery of the Certificates (or effective affidavits of loss in lieu thereof) to the Paying Agent) and instructions for use in effecting the surrender of the Certificates pursuant to such letter of transmittal and (2) in the case of Book-Entry Shares, reasonable and customary provisions regarding delivery of an “agent’s message” with respect to such Book-Entry Shares. Upon surrender to the Paying Agent of Certificates (or effective affidavits of loss in lieu thereof) or Book-Entry Shares, together with, in the case of Certificated Shares, such letter of transmittal, duly completed and validly executed in accordance with the instructions thereto, and such other documents as may be reasonably required pursuant to such instructions, the holder of such Certificates or Book-Entry Shares shall be entitled to receive in exchange therefor the Merger Consideration for each Share formerly evidenced by such Certificates or Book-Entry Shares, and such Certificates and Book-Entry Shares shall then be canceled and of no further effect. No interest shall accrue or be paid on the Merger Consideration payable upon the surrender of any Certificates or Book-Entry Shares for the benefit of the holder thereof. If the payment of any Merger Consideration is to be made to a Person other than the Person in whose name the surrendered Certificates formerly evidencing the Shares is registered on the stock transfer books of the Company, it shall be a condition of payment that the Certificate so surrendered shall be endorsed properly or otherwise be in proper form for transfer and that the Person requesting such payment shall have paid all transfer and other similar Taxes required by reason of the payment of the Merger Consideration to a Person other than the registered holder of the Certificate surrendered, or shall have established to the reasonable satisfaction of the Surviving Corporation that such Taxes either have been paid or are not applicable. Payment of the applicable Merger Consideration with respect to Book-Entry Shares shall only be made to the Person in whose name such Book-Entry Shares are registered.

(c) At any time following twelve (12) months after the Effective Time, the Surviving Corporation shall be entitled to require the Paying Agent to deliver to it any funds which had been made available to the Paying Agent and not disbursed to the holders of Certificates or of Book-Entry Shares (including, all interest and other income received by the Paying Agent in respect of all Payment Funds), and, thereafter, such holders shall be entitled to look to the Surviving Corporation (subject to abandoned property, escheat and other similar Laws) only as general creditors thereof with respect to the Merger Consideration that may be payable upon due surrender of the Certificates or Book-Entry Shares held by them. Notwithstanding the foregoing, neither the Surviving Corporation nor the Paying Agent shall be liable to any holder of Certificates or of Book-Entry Shares for the Merger Consideration delivered in respect of such Share to a public official pursuant to any abandoned property, escheat or other similar Laws. Any amounts remaining unclaimed by such holders at such time at which such amounts would otherwise escheat to or become property of any Governmental Body shall become, to the extent permitted by applicable Laws, the property of the Surviving Corporation or its designee, free and clear of all Encumbrances of any Person previously entitled thereto.

-21-

(d) At the close of business on the day of the Effective Time, the stock transfer books of the Company with respect to the Shares shall be closed and thereafter there shall be no further registration of transfers of Shares on the records of the Company. From and after the Effective Time, the holders of the Shares outstanding immediately prior to the Effective Time shall cease to have any rights with respect to such Shares except as otherwise provided herein or by applicable Laws.

(e) Each of the Paying Agent, Parent, Purchaser and the Surviving Corporation shall be entitled to deduct and withhold from any amounts (including any CVRs in respect of Shares) payable pursuant to this Agreement or the CVR Agreement to any holder of Shares, Company Options, Company RSU Awards or Company ESPP account balances such amounts as it is required to deduct and withhold therefrom under applicable Tax Laws; provided, however, that except for payments to current or former employees of the Company with respect to Company Options and Company RSU Awards, before making any such deduction or withholding, Purchaser shall provide to the Company notice of any applicable payor’s intention to make such deduction or withholding, which notice shall include the authority, basis and method of calculation for the proposed deduction or withholding and shall provide at least a commercially reasonable period of time before such deduction or withholding is required in order for the applicable recipient to obtain reduction of or relief from such deduction or withholding from the applicable Governmental Body or execute and deliver to or file with such Governmental Body or Purchaser such affidavits, certificates and other documents to afford reduction of or relief from such deduction or withholding. To the extent that such amounts are so deducted and withheld, each such payor shall take all action as may be necessary to ensure that any such amounts so withheld are timely and properly remitted to the appropriate Governmental Body, and such amounts so remitted shall be treated for all purposes under this Agreement as having been paid to the Person to whom such amounts would otherwise have been paid.

(f) If any Certificate shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such Certificate to be lost, stolen or destroyed and, if required by the Surviving Corporation, the posting by such Person of a bond, in such reasonable amount as Parent may direct, as indemnity against any claim that may be made against it with respect to such Certificate (which shall not exceed the Merger Consideration payable with respect to such Certificate), the Paying Agent will pay (less any amounts entitled to be deducted or withheld pursuant to Section 3.6(e)), in exchange for such lost, stolen or destroyed Certificate, the applicable Merger Consideration to be paid in respect of the Shares formerly represented by such Certificate, as contemplated by this Article 3.

(g) Notwithstanding anything to the contrary in this Agreement, no holder of uncertificated Shares held through the Depository Trust Company (“DTC”) will be required to provide a Certificate or an executed letter of transmittal to the Paying Agent in order to receive the payment that such holder is entitled to receive pursuant to Section 3.5(a)(iii).

-22-

(h) Prior to the Effective Time, each of Parent, Purchaser and the Company will cooperate to establish procedures with the Paying Agent and DTC with the objective that the Paying Agent will transmit to DTC or its nominees on the first (1st) Business Day after the Closing Date an amount in cash, by wire transfer of immediately available funds, equal to (i) the number of Shares (other than Excluded Shares and Dissenting Shares) held of record by DTC or such nominee immediately prior to the Effective Time, multiplied by (ii) the Merger Consideration.

Section 3.7 Dissenters’ Rights. Notwithstanding anything to the contrary in this Agreement, Shares outstanding immediately prior to the Effective Time, and held by holders who are entitled to demand appraisal rights under Section 262 of the DGCL and have properly exercised and perfected their respective demands for appraisal of such shares in the time and manner provided in Section 262 of the DGCL and, as of the Effective Time, have neither effectively withdrawn nor lost their rights to such appraisal and payment under the DGCL (the “Dissenting Shares”), shall not be converted into the right to receive Merger Consideration, but shall, by virtue of the Merger, be entitled to only such consideration as shall be determined pursuant to Section 262 of the DGCL; provided, that if any such holder shall have failed to perfect or shall have effectively withdrawn or lost such holder’s right to appraisal and payment under the DGCL, such holder’s Shares shall be deemed to have been converted as of the Effective Time into the right to receive the Merger Consideration (less any amounts entitled to be deducted or withheld pursuant to Section 3.6(e)), and such shares shall not be deemed to be Dissenting Shares. Within ten (10) days after the Effective Time, the Surviving Corporation shall provide each of the holders of Dissenting Shares with the second (2nd) notice contemplated by Section 262(d)(2) of the DGCL. The Company shall give prompt notice to Parent of any demands received by the Company for appraisal of any Shares, withdrawals of such demands and any other instruments served to it pursuant to Section 262 of the DGCL, in each case prior to the Effective Time. Unless this Agreement is terminated pursuant to Article 9, Parent and Purchaser shall have the right to direct and participate in all negotiations and proceedings with respect to such demands, and the Company shall not, without the prior written consent of Parent and Purchaser, settle or offer to settle, or make any payment with respect to, any such demands, or agree or commit to do any of the foregoing.

Section 3.8 Treatment of Company Options, Company RSU Awards and Company ESPP.