Press release

Why SOX Compliance Programs needed for Private Businesses?

Sarbanes-Oxley Act of 2002 (SOX) was introduced in the USA to protect the general public and shareholders from fraudulent practices and accounting errors which was going on in several enterprises, and to improve the accuracy of corporate disclosures. The act sets deadlines for compliance and publishes rules on requirements of compliance in the business sector. But it has been completely misunderstood that the auditing and financial regulations of the SOX compliance solely apply to public companies. There are many private companies that haven’t implemented a SOX compliance program because of the less awareness among them. They are completely unaware that there are several provisions in the SOX that completely apply to private companies as well. Apart from this several private companies also think of implementing SOX as a burden and might not realize the benefits. There are severe consequences for not applying SOX compliance to the business. It adds value to the organization as well as enhances the reputation of the firm.read the complete blog here:

https://www.nsktglobal.com/why-sox-compliance-programs-needed-for-private-businesses-

Some of the advantages of opting for SOX Compliance programs by Private businesses include:

Mitigates the risk of Rapid Growth- There are several private companies that grow rapidly. The growth can be either organic or through acquisition and is always suspected of fraud or errors. The sophistication of these organizations often outpaces the skills and capacity of their support functions, including accounting, finance, and tax. Following the SOX compliance with preventive and detective controls measures can help mitigate the risk that comes with the rapid growth of the organization.

Provides assurance to private banks and investors- There are many users other than public shareholders who rely completely on financial information which is very important to save from getting leaked. The added security and accountability that comes with SOX Compliance of having controls in place is an added benefit to these users after incorporating the SOX compliance program.

Helps to strengthen the control structure- Sections 302 and 404 of the SOX Compliance require documentation of several controls, including personnel policies, operations manuals, and recorded control processes. When the auditors and management of the organization focus on internal controls of the company through a SOX assessment. In this way, the organization becomes more aware of the importance of control activities for financial success. The added scrutiny that comes along with a SOX assessment instigates participants to put extra effort in order to ensure that activities happening in the organization which is important for the financial growth of the company are reported and well-executed.

Become one of our subscribers and read these blogs as soon as they are live

https://www.nsktglobal.com/subscribe-us.php

A company’s SOX compliance talks about financial assurance, team work, transparency, audit, control structure, etc. This inspires both investor confidence and market certainty. NSKT Global is one of the top accounting firms which deals in SOX Compliance requirements. It helps private companies comply with all the requirements of the SOX Compliance and how to deal with it in a positive way.

NSKT Global (USA Office)

1564 Market Place Blvd Suite 400 PMB 328

Ocean Isle Beach, NC 28469

Email:- usoffice@nsktglobal.com

Phn:- 888 701 675

888 701 NSKT

https://www.nsktglobal.com/usa

NSKT Global (UAE Office)

Level 14, Boulevard Plaza Tower 1,

Downtown, Dubai, UAE PO 334155

Phn +971 44 394 263

Whatsapp +971 55 171 2487

Email:- uae@nsktglobal.com

https://nsktglobal.com/uae

At NSKT Global we provides the complete range of advisory services to the SMEs as well as to the established businesses. Dealing in the industry for over 10 years. In countries across globe Namely UAE, USA and India.

contact us

https://www.nsktglobal.com/contact-us.php

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Why SOX Compliance Programs needed for Private Businesses? here

News-ID: 2278411 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

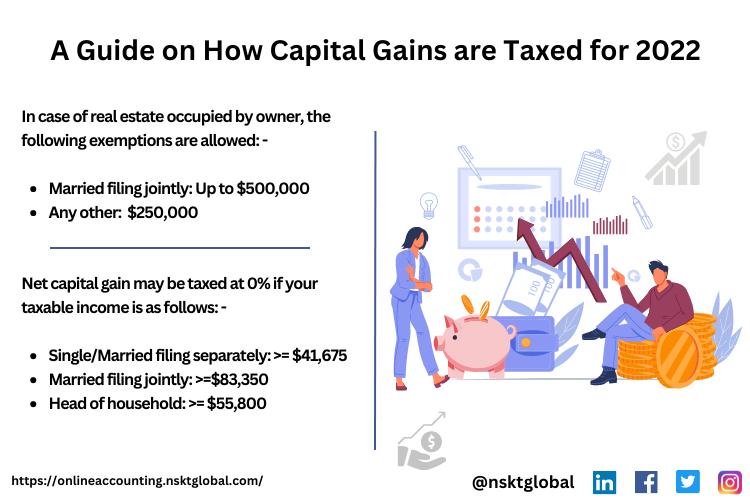

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

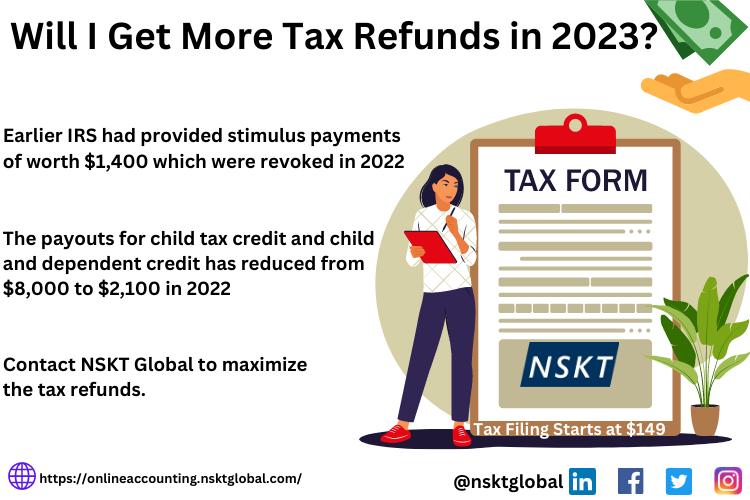

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for SOX

Hybrid SOx Scrubber Systems Market Future Development, Regional Demands and Comp …

The Hybrid SOx Scrubber Systems research report deals with various market aspects and factors and provides the relevant and authentic market information. It shows the growth trends and future opportunities in every region. It delivers a complete analysis of the key segments of the market with the help of charts and tables. The data included in the report is verified through all the liable sources such as Newspapers, Magazines,…

How can your business use SOX tools to demonstrate SOX Compliance?

The Sarbanes-Oxley (SOX) Act was passed in 2002 which forced enterprises to implement protection to help fight the frauds and errors happening in the public as well as private companies. In order to comply with the Act, several companies started following SOX tools and software to manage regulatory obligations and prepare for audits. Given below are some of the best tools used by businesses to demonstrate SOX Compliance:

SolarWinds Security Event…

How does SOX Services help companies in the USA?

Compliance with SOX is not only a legal obligation but also a successful business practice. Companies should, of course, act ethically and restrict access to internal financial systems. But the implementation of SOX financial security controls has the side advantage of also helping to protect the company through insider threat or a cyber attack against data theft. SOX compliance can encompass many of the same practices as any initiative for…

Global SOx Control Systems Market to Witness a Pronounce Growth During 2025

LP INFORMATION recently released a research report on the SOx Control Systems analysis, which studies the Electrical Cord Reels's industry coverage, current market competitive status, and market outlook and forecast by 2025.

Global “SOx Control Systems 2020-2025” Research Report categorizes the global SOx Control Systems by key players, product type, applications and regions,etc. The report also covers the latest industry data, key players analysis, market share,…

VISIBILITY.net ERP Keeps its SOX Up

VISIBILITY.net ERP Stays Current with Features Built to Support Sarbanes-Oxley Compliancy

ANDOVER, MA – June 10, 2010 – Visibility Corporation recently gathered a group of manufacturing company executives, financial officers, and compliancy auditors to review ERP software features needed to help companies remain compliant with Sarbanes-Oxley (SOX) Requirements.

Jack Saint, Visibility Corporation’s President and Chief Operating Officer, chaired the meeting, held on June 8, as part of Visibility’s ongoing efforts to…

Power Systems Company Selects MetricStream for SOX Compliance

MetricStream, Inc., the market leader in enterprise-wide Governance, Risk, Compliance (GRC) and Quality Management solutions, today announced that a leading supplier of modular power components and complete power systems has selected the MetricStream solution for sustainable and cost-effective compliance including the Sarbanes-Oxley Act (SOX).

The company offers power systems and modular power conversion components that are used in several high tech, industrial manufacturing and government markets. These systems and components…