Why is WeWork including a strike by employees among its possible risk factors?

In a filing with the US Securities and Exchange Commission ahead of WeWork’s planned listing next month, the company warns new investors that the prospect of workers going on strike is a potential risk to the performance of its stock.

“If our employees were to engage in a strike or other work stoppage or interruption, our business, results of operations, financial condition and liquidity could be materially adversely affected,” the S-1 filing notes.

Though you can find similar references in filings for automakers or other manufacturers, it’s an unusual risk factor for a real-estate company to draw attention to, according to securities law experts. It also raises the question of whether WeWork is concerned.

“It is not a common factor but they may know that they have difficult labor relations,” says law professor John Coffee Jr., director of the Center on Corporate Governance at Columbia Law School. “If you know a strike is a realistic possibility, it certainly deserves to be disclosed.”

Earlier this year, the company was sued by two former executives who accused the shared-office company of gender and age discrimination. In 2018, WeWork was sued by its former director of culture, Ruby Anaya, who alleged she was wrongfully terminated after filing complaints about facing sexual harassment at company events; the lawsuit described WeWork as having a “frat-boy culture that starts at the top.” In 2015, WeWork cleaners protested over wages, which led to WeWork announcing that it would use unionized contractors for janitorial services at its locations in New York and Boston.

WeWork declined to tell us why it listed the possibility of an employee strike as a risk factor, but here’s how the company characterizes its labor relations, in the S-1:

“Although we believe that our relations with our employees are good, if disputes with our employees arise, or if our workers engage in a strike or other work stoppage or interruption, we could experience a significant disruption of, or inefficiencies in, our operations or incur higher labor costs, which could have a material adverse effect on our business, results of operations, financial condition and liquidity. In addition, some of our employees outside of the United States are represented or may seek to be represented by a labor union or workers’ council.”

The filing also mentions that “third-party strikes” may cause “supply chain interruptions,” which could increase costs or reduce revenues—fairly common warnings for public companies these days, based on a Quartz analysis of risk factors listed by companies in the S&P 500 Index.

The specter of a strike by WeWork’s own employees, which also was mentioned in a previous draft of the S-1 submitted in late December, is a more unusual type of risk factor—although ride-sharing giant Uber, which went public earlier this year, warned investors about the potential risks from “difficulties in managing, growing, and staffing international operations, including in countries in which foreign employees may become part of labor unions, employee representative bodies, or collective bargaining agreements, and challenges relating to work stoppages or slowdowns.”

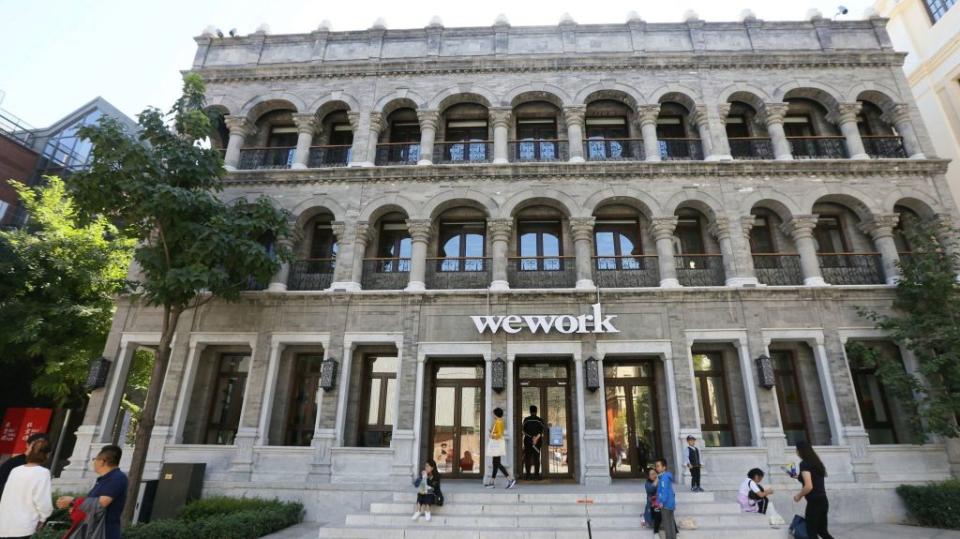

WeWork, founded in 2010 by Adam Neumann and Miguel McKelvey, rents out co-working spaces to startups, freelancers, and large companies in 528 locations around the world. As it continues to expand, there could be a real concern if large groups of employees decided to strike, says Florida securities lawyer Laura Anthony, founding partner of Anthony L.G. PLLC.

A sign of the times

Amid the heightened employee activism coming out of Silicon Valley and elsewhere, WeWork’s inclusion, in its risk factors, of a possible strike by workers is a timely reference. Just last week, employees at Equinox and SoulCycle called for a strike, after the billionaire real estate developer Stephen Ross, an investor in both brands, hosted a fundraiser in the Hamptons for Donald Trump’s re-election campaign. In June, in Boston, Wayfair employees walked out to protest the company’s sale of furniture to a detention center in Texas. That we are now seeing the risk of employee strikes surfacing in financial disclosures by non-union companies outside the manufacturing sector shows how meaningful strikes have become.

“There could very much be a trend,” says Spencer G. Feldman, a corporate and securities lawyer who focuses on public securities offerings and media and technology transactions. “Such strikes could materially affect the company’s operation and ultimately financial condition.”

In addition to noting the risks associated with a work “stoppage” (it did not use the word “strike”), Uber’s S-1 in April addressed the wave of scandals and negative press coverage that led to the eventual ouster of former CEO Travis Kalanick. The filing refers to the 2017 #DeleteUber campaign, as well as to a blog post by a former engineer that detailed the company’s history of toxic culture and sexual harassment.

“It can’t be ignored any longer—it’s gotten beyond the normal course of business,” says Feldman, who is a partner at Olshan Frome Wolosky LLP in New York. “The employee protests have become explosive, contagious, and dangerous.”

Strikes also could get expensive, making them something investors should know about. With employees walking out, “there could be a loss of productivity, loss of revenue, bad publicity,” says Feldman. “There is potential to create some meaningful problems.”

WeWork’s unusual risk factor also perhaps reflects the evolving guidance of the SEC. Just last week, the regulatory agency proposed changes to modernize disclosures by having companies give more recognition to intangible assets like “human capital,” and to have them draw attention to risks that go beyond boilerplate language, Anthony notes.

WeWork’s risk factor may influence other big companies such as Airbnb that are looking to go public down the road. Anthony suggests we also might see mass shootings become a more common risk factor listed in filings. “Human capital is a new focus,” Anthony says.

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz: