Christian Strenger is Academic Co-Director at the Center for Corporate Governance at HHL Leipzig Graduate School of Management; Johannes Beyenbach is a Research Associate at the Center for Corporate Governance at HHL Leipzig Graduate School of Management; Marc Steffen Rapp is Professor of Business Administration and head of the Management Accounting Research Group at Philipps-Universität Marburg; and Michael Wolff is a Professor at the University of Göttingen. This post is based on their recent paper. Related research from the Program on Corporate Governance includes The Elusive Quest for Global Governance Standards by Lucian Bebchuk and Assaf Hamdani.

Scope of the Study

The aim of the study is to analyze the compliance behavior of the largest listed German firms with the German Corporate Governance Code in 2017 (subsequently the “Code”). The Code was introduced in February 2002 and provides three types of provisions that encompass the German governance environment:

- Legal stipulations, that oblige companies to follow the applicable law.

- “Shall”-Recommendations, not required by law that have to be followed by the comply-or-explain approach (marked in the text by the word “shall”). Firms that do not comply with these recommendations have to explain their reasons in their declaration of conformity.

- “Should”-Suggestions, where companies do not need (but are suggested) to report their deviations from them (marked in the text by the words “should/can”). The German Corporate Governance Code primarily addresses listed companies and has a legal basis through the declaration of conformity pursuant to article 161 of the Stock Corporation Act (AktG). Accordingly, the boards of listed companies have to declare their conformity with the Code’s recommendations. The case of non-compliance has to be explained. Our analysis is based on these declarations. Compliance is therefore measured by the conformity of the corporation’s governance system with regard to the fulfillment of the Code’s “Shall”-Recommendations.

Following the foreword, the Code has “Shall” Recommendations in six chapters: (2) Shareholders and the General Meeting, (3) Cooperation between Management Board and Supervisory Board, (4) Management Board, (5) Supervisory Board, (6) Transparency and (7) Reporting and Audit of the Annual Financial Statements. The Code’s current version from February 7th, 2017 contains 86 recommendations and 10 suggestions. Chart 1 illustrates the distribution of the recommendations and suggestions along the code’s structure.

Methods—Sample and Analysis

We evaluated the declarations of conformity published by 80 companies listed in the key German stock market indices DAX (30) and MDAX (50) to analyze the extent of compliance with the Code. Four companies were excluded as they are not German-based. Our final sample therefore comprises 76 listed corporations. The companies’ declarations of conformity were collected from the firms’ websites. The Deutsche Börse Weighting Files, accessed on 29.12.2017 were used regarding index composition, market capitalization and ownership concentration (“Free Float Factor”). The overall acceptance and general level of compliance on both chapter and item level has been analyzed for which the study refers to the 61 items of the Code (amended on February 7th, 2017.) On this basis, the ratio to which a company corresponds to all 61 items is calculated. If a company deviates from one recommendation, the compliance rate amounts to 98.4 percent, a rejection of two recommendations results in a compliance rate of 96.7 percent. Next, we created four aggregated indices to capture the governance quality of the observed firms: (a) “Transparency”, (b) “Incentive Systems”, (c) “Monitoring & Control”, and (d) “Diversity”.

By aggregating 41 well-chosen code elements these indices reflect different governance attributes and serve as a broad measure of a company’s governance implementation practice. The index for “Transparency” includes 15 items, the “Incentive System” index encompasses 7 governance elements, the index “Monitoring & Control” consists of 13 elements and the “Diversity” index of 6 elements.

Previous studies in corporate governance research have shown that code compliance is determined by firm size (market capitalization) and ownership concentration. Therefore, we finally investigate differences in the compliance behavior of firms based on these two characteristics.

The result of the study is an up-to-date and in-depth picture of code acceptance and compliance behavior with a differentiated and individual perspective on Germany’s largest listed companies.

Results

General Compliance

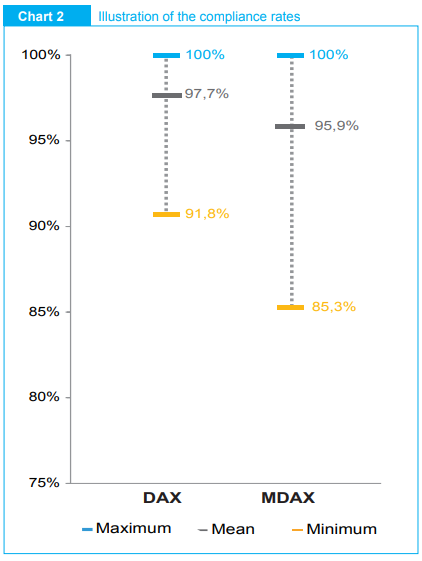

With regard to all companies examined, the analysis shows a positive picture: the acceptance rate of 96.6 percent reflects a high level of acceptance. In comparison to the previous year the compliance rate has increased slightly. As chart 2 shows there are significant differences between DAX and MDAX companies regarding their compliance rate with the Code: compared to an average acceptance level of 97.7 percent of the “Shall”-Recommendations for DAX-companies, the acceptance rate for MDAX-companies is at 95.9 percent. While many companies accept all recommendations of the Code, 7 percent of the companies examined do not comply with 10 percent or more of the recommendations. The analysis also indicates that about one third of the DAX companies fully comply with all the recommendations of the Code whereas only 22 percent of the smaller MDAX companies fully accept the Code’s “Shall”-Recommendations. Chart 2 also shows that there are companies with compliance rates below 90 percent: for MDAX companies the minimum value is 85.3 percent.

The Code also contains “Should”-Suggestions, which can be deviated from without explanation. However, item 3.10 of the Code encourages companies to comment voluntarily on the seven suggestions of the Code. Our study finds that only 7 percent follow that suggestion.

A peculiar explanation of non-compliance emerged in the last years: the so called “precautionary non-compliance” with the Code. Companies then declare that they deviate from particular recommendations of the Code for certain reasons but feel that this may be an overstatement. The proportion of such “precautionary non-compliance” declaration with recommendations of the Code remains with 8 percent on a considerable level. This questionable approach of compliance especially affects items in chapter 4 (Management Board), i.e. the structure of the compensation of the management board, and chapter 5 (Supervisory Board), i.e. compensation and composition of the supervisory board and its audit committee.

Compliance on Chapter and Item Level

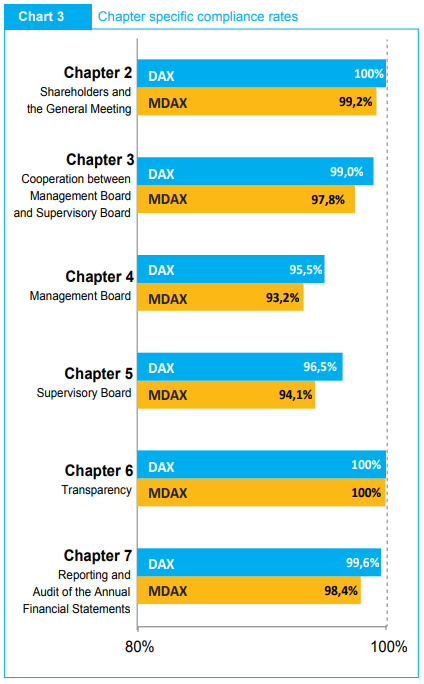

A chapter-specific analysis of the compliance rates is shown in chart 3: While chapter 2 (Shareholders and the General Meeting), chapter 3 (Cooperation between Management Board and Supervisory Board), chapter 6 (Transparency) and chapter 7 (Reporting and Audit of the Annual Financial Statements) show high compliance rates, non-compliance is identified in chapter 4 (Management Board) and chapter 5 (Supervisory Board). A closer look shows that some of the items have compliance rates below 90 percent which are labeled “critical” items: 3.8 (D&O Insurance), 4.2.3 (Structure of the Management Compensation), 4.2.5 (Disclosure of the Compensation of the Management Board in Model Tables Provided by the GCGC), 5.3.2 (Audit Committee), 5.3.3 (Nomination Committee), 5.4.1 (Composition of the Supervisory Board), 5.4.6 (Compensation of the Supervisory Board). The lowest acceptance rate with 58 percent is found for item 4.2.3 (Structure of the Management Compensation). The recommendation for the definition of maximum amounts of the management compensation is responsible for the low acceptance rate in this item. The second lowest compliance rate of all companies is found in item 5.4.1 (Composition of the Supervisory Board) (61 percent). Especially the recommendation for the specification of concrete objectives regarding the composition of the supervisory board is then not accepted by companies.

The Code also contains “Should”-Suggestions, which can be deviated from without explanation. However, item 3.10 of the Code encourages companies to comment voluntarily on the seven suggestions of the Code. Our study finds that only 7 percent follow that suggestion.

Compliance rate: Company size and ownership concentration

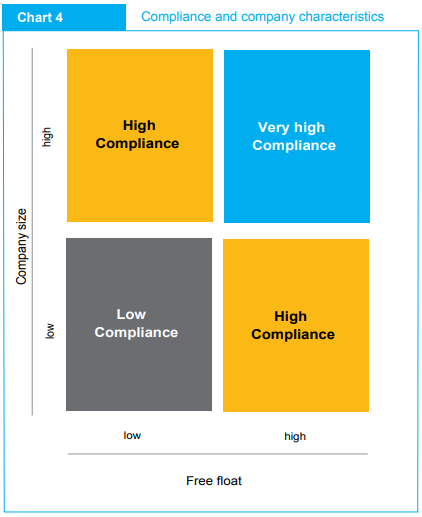

The study also investigates how different company characteristics can explain compliance rates. Firstly, all companies are categorized into three size classes according to their market capitalization. For each size class the average compliance rate over all items is determined. The analysis shows that larger companies have higher compliance rates.

Secondly, the ownership concentration according to the free float is reviewed. The result shows that companies with a higher free float also have higher compliance rates. Both effects can be regarded independently from each other so that the context of size, ownership concentration and compliance rate can be illustrated as in chart 4.

Governance Indices

The following four governance indices (a) “Transparency”, (b) “Incentive systems”, (c) “Monitoring & Control“, and (d) “Diversity” are built by an aggregation of 41 well-chosen code elements that reflect different governance attributes and serve as a broad measure of a company’s governance implementation practice.

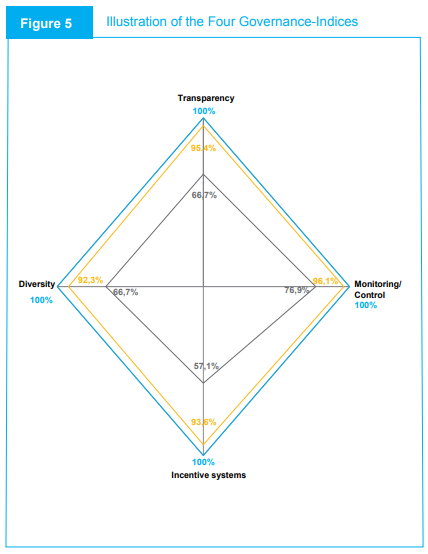

Chart 5 shows that on average all indices reach high standards. They, however, reach lower standards then the overall compliance rates. The high heterogeneity between the indices is also noteworthy: for the indices “Incentive system” there are companies that only reach just over 50 percent of the maximum possible result.

In comparison with the previous year’s study several companies are more prepared to comply with the recommendations of the “Diversity” index. The minimum now lies at 67 percent (50 percent the previous year), and the mean increased by 1.3 percent to 92 percent. For the “Transparency” index, the minimum remained at 67 percent, whilst the “Monitoring & Control” index remained at 77 percent.

When examined separately, DAX and MDAX companies are characterized by heterogeneity: For three quarters of the DAX companies the indices “Monitoring & Control” and “Transparency” reach the highest results. For MDAX companies only half of the companies reach the maximum here.

Conclusion

This study systematically and comprehensively examines the acceptance of the current 14th version of the German Corporate Governance Code.

The Code adopted the comply-or-explain principle requiring that companies to either fulfill the specific recommendations or to explain why they do not follow these recommendations. Our analysis shows that the compliance rates remain at a high level. Only a small number of companies reject important parts of the Code. However, as in previous years, the proportion of “precautionary” and “highly precautionary” deviations remains unsatisfactorily high. In particular recommendations in chapter 4 (Management Board) and chapter 5 (Supervisory Board) are rejected, especially those regarding the structure of management board compensation, disclosure of compensation components, the composition of the supervisory board and also the supervisory board compensation. Particularly noteworthy are item 5.4.1 (Composition of the Supervisory Board) and item 4.2.3 (Structure of the Management Board Compensation). With a compliance rate of 58 percent, item 4.2.3 is shown to have the highest deviation rate of all items. Item 5.4.1 has the second highest deviation rate of all companies with a compliance rate of 61 percent.

The assessment of the impact of company specific determinants of code compliance reveals that larger companies with substantial free-float exhibit higher compliance rates. A separate analysis of the items of the code with regard to the topics of Transparency, Monitoring & Control, Incentive Systems and Diversity provides in-depth insights into the compliance culture of companies. With regard to Incentive Systems, a slightly increasing trend emerges: More DAX and MDAX companies have maximum compliance scores for this index in comparison to the previous year. Regarding the index Diversity, in the majority of cases DAX and MDAX companies reject the relevant recommendations.

In summary, we observe that the Code compliance rates are stable at a generally high level. Future improvements of the compliance rates should significantly depend on higher conformity with the recommendations concerning the Management Board compensation.

Reference: German Corporate Governance Code

(latest version: February 7th, 2017): http://www.dcgk.de/en/code.html

Print

Print