On Tuesday afternoon, Yahoo’s CEO Marissa Mayer said that the company would be exploring "strategic alternatives” for its Web businesses, including a 15 percent cut in staffing, the closure of five global offices, and potentially divesting "non-strategic assets of value."

The announcement happened before Yahoo’s fourth-quarter financial call in which the company reported $4.968 billion in revenue for 2015, an 8 percent year-over-year increase from 2014's revenue. Revenue for Q4 2015 was $1.27 billion. Still, the company reported a hit with a one-time $4.5 billion "goodwill impairment charge" in this final quarter, likely a write down from expensive acquisitions.

The company said that it was in need of simplification measures, saying that "a smaller product portfolio emphasizing Yahoo's core strengths will yield better focus, execution, and ultimately clearer value to shareholders, advertisers, and users." In a press release, Yahoo called out Games and Smart TV as verticals that would be shut down in 2016. In addition, the company said that it would engage in "cost saving efforts" to reduce the number of employees to 9,000 and the number of contractors to 1,000 by the end of 2016. Yahoo also said it would close offices in Dubai, Mexico City, Buenos Aires, Madrid, and Milan within the next three months.

Mayer said the mass layoffs and closure of offices would generate a savings of $400 million. In response to a question about whether Yahoo would suspend all acquisitions and hiring over the year, the CEO said "tech is a very acquisitive industry... we will continue to hire and we will continue to acquire but I feel the need is slightly less acute now."

"Yahoo can not win the hearts and minds of consumers with a complex and fragmented portfolio of products," Mayer added.

Toward the end of her address to investors, Mayer also denied recent reports of lavish Yahoo holiday parties and imprudent spending at the company. Calling out "blatant falsehoods circulating in the press," Mayer said that the company's holiday parties "cost approximately $150 per attending employee."

Another big concern during the call was how Yahoo's reverse spin-off of Alibaba would proceed. In December, Yahoo announced that it would spin off its Web businesses into a separate company and have the primary property become a holding company for Yahoo’s considerable Alibaba shares. Yahoo's 15-percent stake in the Chinese e-commerce company is currently worth $31 billion, and as such, it’s easily the most profitable part of Yahoo.

But the announcement to separate Alibaba and Yahoo wasn’t met with approval across the board. The decision was essentially a reversal of an earlier plan to spin Alibaba off and keep Yahoo’s Web businesses as they were, and investors felt the change of course—explained by executives as a way to avoid heavy taxation on Alibaba’s net worth—would delay the separation of the businesses unduly and keep investors tied in a unified Yahoo that struggled to improve profits. As such, activist investors called for more immediate action from Mayer or for her resignation.

Mayer made it clear on today's call that the reverse spin-off of Alibaba would move forward in 2016 and would likely be completed in nine to 10 months. During that process, Mayer said that "the board will also engage in pursuing qualified strategic alternatives" for other parts of Yahoo's business (read: possibly selling them off), although the company stressed in its press release that these "alternatives" would not affect core businesses. "Yahoo has begun to explore divesting non-strategic assets of value such as the responsible monetization of non-strategic patents, the sale of valuable real estate, and other non-core, non-strategic assets," Yahoo wrote. "Through the end of the year, the Company estimates that these efforts could generate between one and three billion dollars in cash."

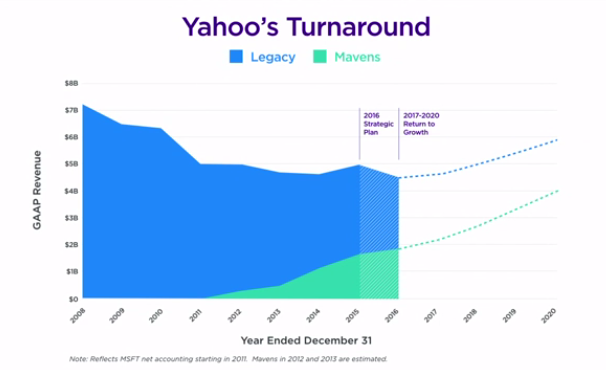

While the company admitted it was still being dragged down by legacy programs, Mayer praised her MaVeNS program, which loosely stands for Mobile, Video, Native, and Social. The CEO said these areas would drive increasing growth while Yahoo let some of its legacy business go. In 2015, the program resulted in $1.6 billion in revenue, Mayer said, and the company was on track to bring in $1.8 billion in revenue in 2016.

When questioned about how Yahoo saw mobile search as different from Web search, Mayer said, "in mobile search, it's much more personal... the search space is basically much smaller... I do think this is an area that's really deeply in need of some imagination." Mayer also added that, currently, "Mail services are Yahoo's largest traffic and engagement drivers."

reader comments

92