The biggest newsworthy story overlooked by the market

Schroders

It’s every fund manager’s quest to find undervalued gems in the market, particularly quality companies that can compound growth into the foreseeable future. In today’s world of rock bottom bond yields, the price being paid for these growth companies has never been higher. But what if I told you there was one such ASX listed company trading at a bargain basement price, completely overlooked by the market? What if I told you this company has one of the best collections of growth businesses listed on the ASX? In the words of Darryl Kerrigan from the Castle, “Tell him he’s dreaming” I hear you say. This company is Newscorp (ASX:NWS), and it appears the board agrees with our view that it is significantly undervalued, having just authorised a US$1 billion buy back.

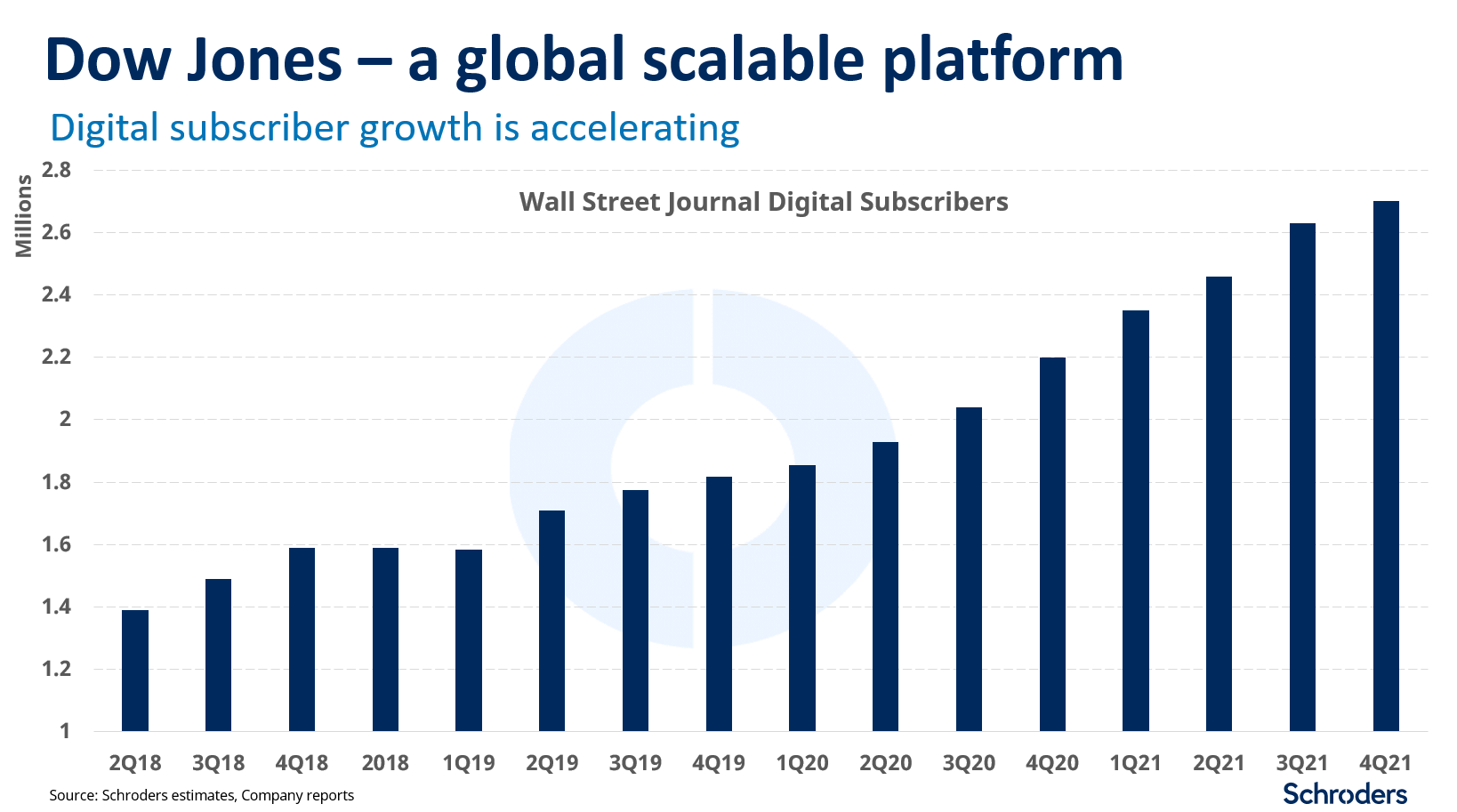

The Dow Jones – a fast growing digital asset

One of Newscorp’s best assets is the Dow Jones business, owner of the Wall Street Journal. The Wall Street Journal operates in over 45 countries and is one of the most trusted news mastheads around the world. The business has similar characteristics to Netflix and Spotify. Like these companies, the Dow Jones curates and produces high demand content across a scalable platform, with revenue being predominantly subscription based. Digital now accounts for 60% of revenue which is accelerating (+22% last reported), with subscribers up 70% to 2.7 million since 2018. The stark difference is that Dow Jones’ profit margins are expanding, and content cost inflation is modest given limited competition for journalism talent.

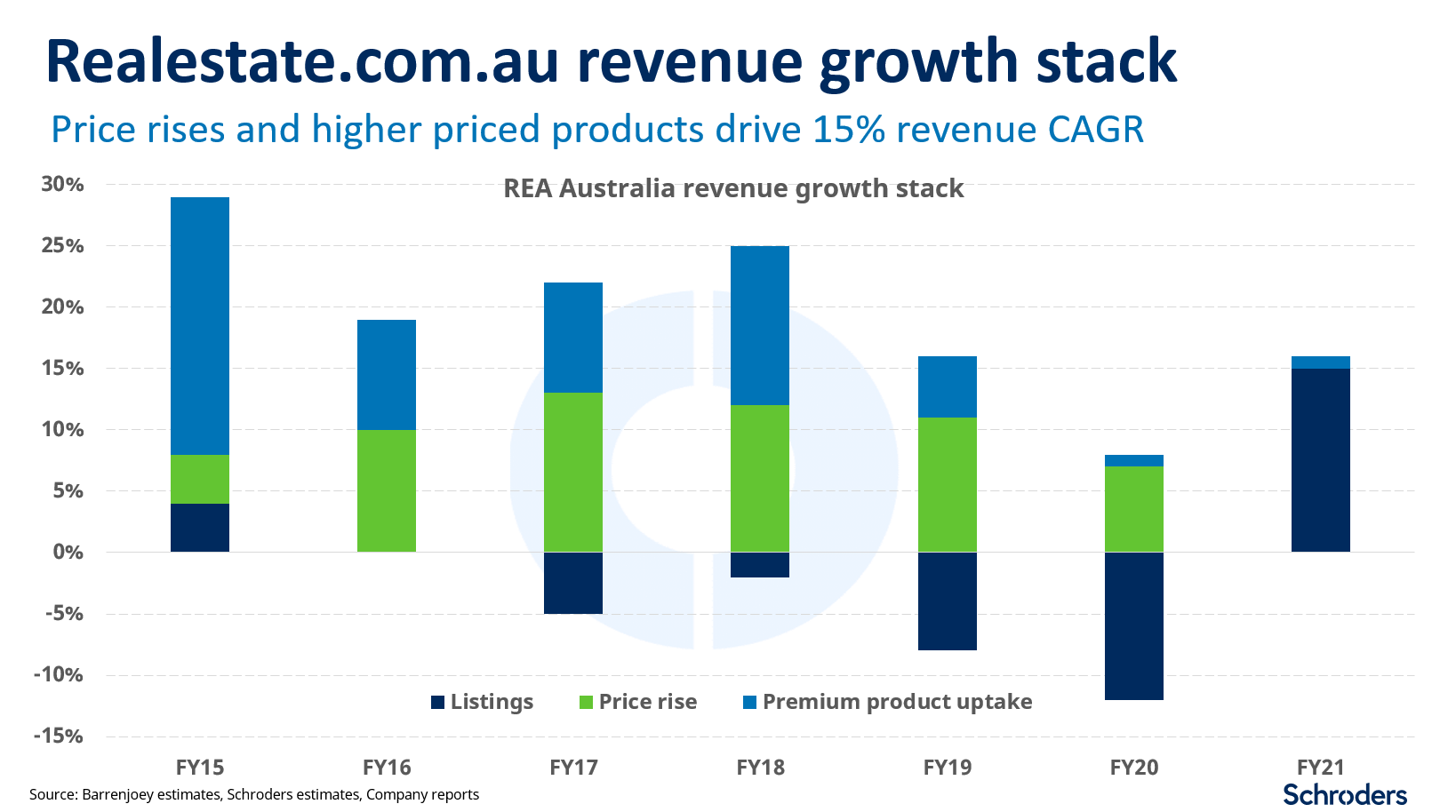

Digital real-estate services – the housing market exchange

The other prized assets are Newscorp’s 62% ownership of ASX listed REA Group (ASX:REA) and Move, two fast growing businesses leveraged to the housing market.

Realestate.com.au continues to dominate the Australian real estate classifieds market, and benefits from vendor (the home seller) paid advertising. Vendor paid advertising is unique to Australia, as in other markets advertising costs are borne by the agent. This has allowed REA Group to seamlessly introduce new higher priced advertising packages, peddled by real estate agents to their vendors. The quid pro quo for agents is they use vendor paid funds to promote their agency profile within listings, in effect becoming REA Group’s sales force. In fact, REA has conspicuously priced packages to match house prices by various post codes, replicating market exchange like characteristics with little capital intensity. When house prices rise, REA puts up its prices.

Newscorp’s second digital real estate asset is Move, owner of Realtor.com, the second most visited real estate portal in the USA behind Zillow. Move’s revenue growth has started to accelerate (+36%YoY in FY21) and is benefiting from a strong housing market and the introduction of the agent referral model. Realtor.com is now charging agents to match them to its audience of buyers and sellers. Referral prices are based on post codes, house prices and volume of leads purchased. Agents are becoming dependent on these platforms and are competing for buyers and sellers, driving up Realtor.com’s audience referrals to 30% of revenue. As home prices rise, so do referral lead prices.

But wait there’s more! Book publishing is another hidden asset

Within Newscorp, there is another hidden gem - book publishing business HarperCollins, the second largest book publisher globally. HarperCollins offers up to 140,000 digital publications and is the publisher of the popular Divergent series, Boy Swallows Universe, and romance and Christian genre titles. Other well-known authors in the HarperCollins stable include Harper Lee, George Orwell and J.R.R Tolkien.

This is a global business operating in 17 countries that generates revenue when books are purchased and is effectively a content licensing powerhouse.

Approximately 60% of revenue now comes from the back catalogue, which is an annuity business. In FY21, the book publishing business grew revenue by 14%. Demand for both physical and digital books is growing, with strong demand for audio books driving higher growth rates for digital revenue.

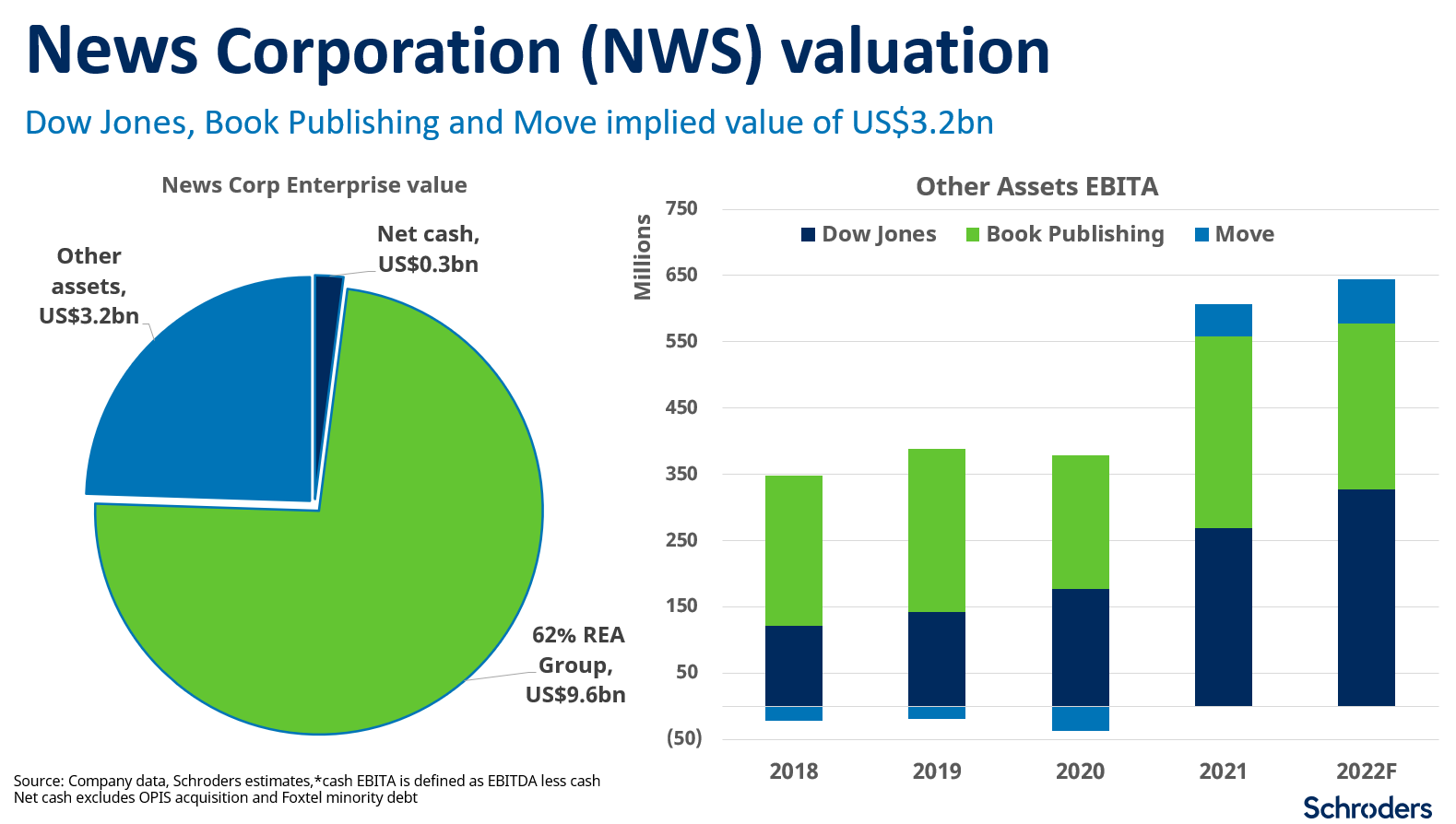

So how cheap is Newscorp?

Newscorp’s current enterprise valuation is US$12.9bn. Backing out the 62% stake owned in REA Group - valued at US$9.6bn - the implied value for the rest of the assets is US$3.2bn. For this price, you get the Dow Jones, Move and Harper Collins businesses, which generate a combined revenue and EBITA of US$4.3bn and US$0.6bn respectively. This implies an EBITA multiple of 5x, or a 20% cash return that is growing. Find me another scalable, global business that is growing, with high rates of return on capital offering you a 20% cash yield return today!

For context, The New York Times (NYT) which is listed on the New York Stock Exchange (NYSE) is the most comparable company to Dow Jones and is valued at US$8.6bn (26x EBITA). Applying this valuation to Dow Jones would imply a market valuation of US$7bn. That is double the current implied market pricing, with HarperCollins and Move thrown in for free! Another company comparable to Move is Redfin Corp, a Nasdaq-listed technology-powered real estate company. The market values Redfin at US$5.8bn, a company that generates half of Move’s US$116m EBITA.

Newscorp remains one of the most undervalued stocks in our portfolio, and one of the highest quality companies listed on the ASX in our view.

The Murdoch family, which controls 38.4% of voting stock, have a history of entrepreneurial and deal-making spirit. The best examples include the creation of the Fox Broadcasting Company in 1986, Fox News in 1996, the majority acquisition of REA Group in 2005 and the recent sale of 21st Century Fox to Disney in 2019. Through Newscorp the Murdochs are industry mavericks, and it is largely thanks to their efforts that global tech platforms Google and Facebook are now paying for journalistic content around the world.

We expect the board and management will continue to undertake initiatives to improve shareholder value given a discount valuation.

Learn more

The Schroder Wholesale Australian Equity Fund is an actively managed core Australian equity portfolio with a focus on investing in quality stocks predominantly in Australia characterised by strong returns on capital with a sustainable competitive advantage.

For further insights from the Schroders Australian Equity team, visit the profiles of Martin Conlon or Joseph Koh

Readers should be aware that, as at the date of this publication, we hold positions in Newscorp in funds and mandates that we manage.

2 stocks mentioned

1 fund mentioned

2 contributors mentioned

Expertise