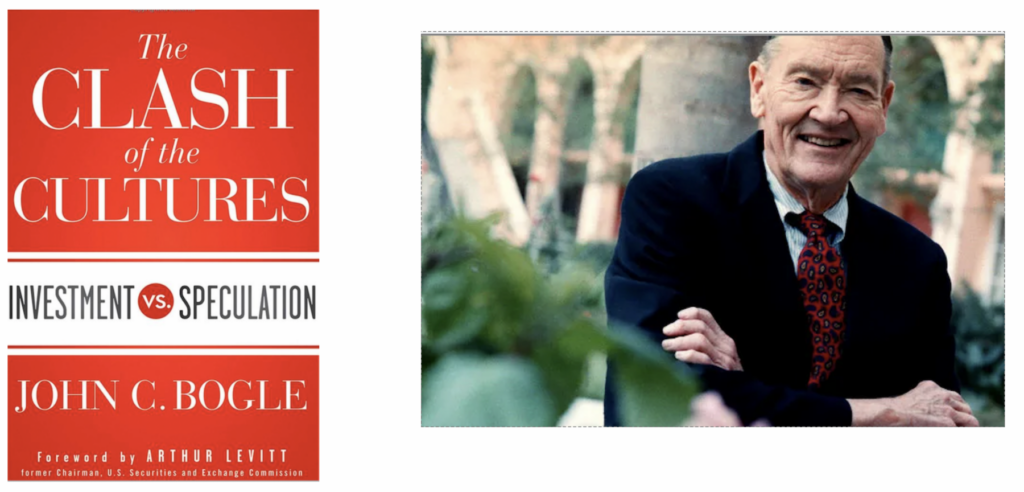

Vanguard founder Jack Bogle’s passed away 3 years ago today. In 2016, I was lucky to have had the opportunity to interview him in his office for Masters in Business.

Bogle argued for an approach to investing defined by simplicity and common sense. His book The Clash of the Cultures: Investment vs. Speculation has 10 rules laid out in great detail in Chapter 9, and they sum up the Bogle philosophy as:

Investing Versus Speculation

1. Remember Reversion to the Mean

2. Time Is Your Friend, Impulse Is Your Enemy

3. Buy Right and Hold Tight

4. Have Realistic Expectations: The Bagel and the Doughnut

5. Forget the Needle, Buy the Haystack

6. Minimize the Croupier’s Take

7. There’s No Escaping Risk

8. Beware of Fighting the Last War

9. The Hedgehog Bests the Fox

10. Stay the Course

Bogle goes into the specific details of each of these 10 rules, with a detailed explanation here. You can also learn more at John C. Bogle, or at the Bogleheads site.

A few other people have tried to reduce this to its most basic rules for investing, including Bogleheads and Wikipedia :

Bogle’s Rules

1. Select low-cost funds

2. Consider carefully the added costs of advice

3. Do not overrate past fund performance

4. Use past performance to determine consistency and risk

5. Beware of stars (as in, star mutual fund managers)

6. Beware of asset size

7. Don’t own too many funds

8. Buy your fund portfolio – and hold it

Do not underestimate the power of their simplicity — this is far more subtle and nuanced than appears at first glance. And for many people, it is much harder to follow than you might imagine.

All of our prior sets of rules can be found here.

Previously:

MiB: Jack Bogle on Indexing (March 14, 2016)

Jack Bogle’s Three Great Insights January 17, 2019 (Bloomberg)