Expansionary fiscal policy combined with Taylor-rule induced monetary tightening has resulted in a strong dollar. That strong dollar is driving US agricultural prices.

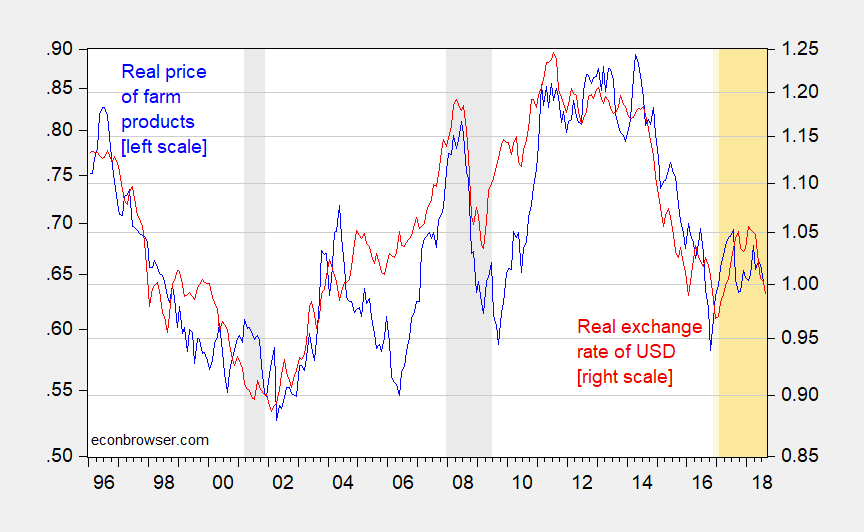

Figure 1: Farm product PPI divided by CPI-all (left log scale, blue), and real trade weighted US dollar exchange rate, against broad basket (right log scale, red). An increase in the dollar exchange rate variable is a dollar depreciation. NBER defined recession dates shaded gray; Trump administration shaded orange. Source: BLS, Federal Reserve Board, NBER, and author’s calculations.

Notice the close correlation between the inflation adjusted series. Neither series rejects a unit root, using conventional ADF tests. A Johansen maximum likelihood test for cointegration rejects (using asymptotic critical values) the no-cointegration null at the 12% msl, but fails to reject the one cointegrating vector at the 10% msl (for both trace, maximal eigenvalue test statistics).

The estimated cointegrating vector (assuming no trend in cointegrating equation) is:

ppifarm = 1.43q – 0.475

Where ppifarm is the log PPI for farm products deflated by CPI-All, and q is the real dollar exchange rate.

From March 2018 — when the first protectionist measures were announced — through August, the real value of the USD has fallen by 5.8% (log terms). That implies an 8.3% real price reduction in farm prices since March, alone.

The interpretation I’ve adopted is that the real dollar is weakly exogenous (i.e., the cointegrating vector is weakly exogenous for relative farm prices). This seems reasonable from a theoretical perspective, where farm prices do not “cause” the value of asset prices like the dollar.

However, it’s reassuring that the VECM that corresponds to the cointegrating system estimated is one where one can reject the null hypothesis that farm prices do not respond to statistical disequilibria, but fails to reject the null the dollar does not.

As is often true for me with the more mathematical/ equation based posts, not conceptualizing a large portion of this. But will breakdown the terminology and see if I can get a broad grasp of it. When I compare myself in Economics to a guy like Menzie, Krugman, or Stanley Fischer I rank myself about a 2 on a 1-to-10 scale. When I compare myself to the broad public and politicians I rank myself a strong 8. So what are the odds a Navarro, Kudrow, or trump are grasping the implications of the above, if I am only grasping a small portion of it?? Like being told Roseanne Barr is the new moderator of your group mental therapy sessions.

Strong dollar is caused by debt ceiling.

I don’t doubt the good and honest intentions in the strong concerns but if you’re ever in political power you dig a tomb for the nation.

Not that Swisher is the first to open this topic, but still a good read. This is another of many reasons why Tim Cook’s pandering (or panhandling??) to trump is bothersome:

https://www.nytimes.com/2018/09/13/opinion/google-censorship-trump-china.html

https://goo.gl/images/4vGHtP

https://www.politico.com/story/2018/09/18/tim-cook-apple-trump-trade-tariffs-794708

As a homosexual man, one “would think” that Tim Cook is aware of the dangers of flirting with a megalomaniac with fantasies of authoritarianism—apparently Cook being a member of a severely oppressed segment of society has provided Cook with no enlightenment in this realm. “Leading by example” appears to be lost on Mr. Cook when there is no payoff or remuneration in it.

This more recent trump trade move also indirectly/loosely relates to elasticity, as I believe elasticity for electronics and elasticity for farm products is quite different, which I’m relatively certain Menzie has written about on this blog before.

Dr. Chubb – Always enjoyed your commentary but as a non-economist this one is throwing me for a loop. Could you put into layman’s term why an increase in the dollar exchange rate variable is a dollar depreciation?

Abe: This is an international finance convention, where the “exchange rate” is defined as the “price of foreign currency”, e.g., for an American, how many US dollars to buy a single euro. Using such a convention, a rise in the “exchange rate” is a depreciation/devaluation.

Weird question but even weirder – who is “Dr. Chubb”????

@ pgl

I was thinking the exact same thing. I’m going to Google this in about 25 seconds and I have the distinct sense I am going to be “let down” in this query.

Professor Chinn,

Trying to duplicate your charts, I assume that the real price of farm products is computed using the FRED series: wpu01/cpiaucsL.

However, I don’t think I understand the exchange rate portion of your chart. If I use the FRED real exchange rate broad based series, twexbpa, I don’t show the same values as you show.

A little help is needed.

Thanks

AS: I divided by 100 and inverted.

I thought you had divided by 100, but did not think about the inversion, except that the inversion captures that the price of goods in dollar terms would move inversely to the value of the dollar ( if I am thinking correctly).

If I have duplicated your model somewhat correctly, it looks like an ECM model is saying that the forecasted farm price decline for September 2018 may be about 1.3% in real terms. Does this seem close to what you might think?