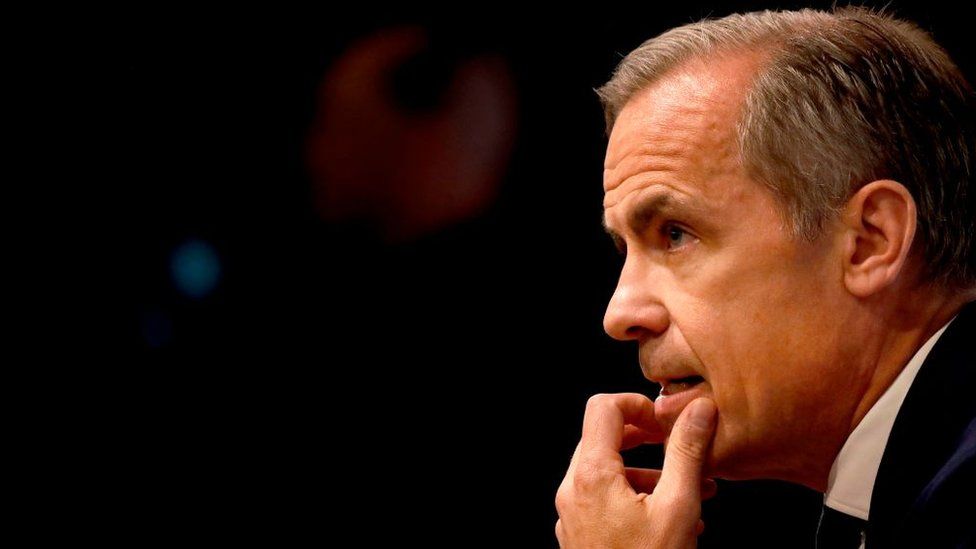

Carney: The cost of Brexit to households

- Published

- comments

The Brexit vote has left households worse off, Bank of England governor Mark Carney has said.

The vote to leave the European Union had lowered growth by "up to 2%", he told MPs on Tuesday.

However, there could be a "sharp pick-up" in business investment when a Brexit agreement is struck, he said.

Meanwhile, new figures showed the government finances have continued to improve, potentially giving the Chancellor more Budget spending power.

Giving evidence to the Treasury Committee, Mr Carney said: "Real household incomes are about £900 lower than we forecast in 2016. The question is why and what drove that difference. Some of it is ascribed to Brexit."

Asked about the governor's comments on a visit to Argentina, Foreign Secretary Boris Johnson said: "I believe the Chancellor of the Exchequer [Philip Hammond] has given an authoritative opinion on this matter, which is that it is absolutely not the case that Brexit has damaged the interests of this country."

Mr Carney said business investment was still being held back, but there was a chance of a "sharp pick-up" when the Brexit agreement is finalised.

"It's understandable why businesses are holding back - there's some big decisions that are about to be made - why wouldn't they want to wait until the path becomes clearer?" he told MPs.

Borrowing falls

Meanwhile, the government borrowed £7.8bn in April - the lowest figure for April since 2008, according to official figures.

The Office for National Statistics (ONS) also revised the borrowing figure for last year to £40.5bn, down from its previous estimate of £42.6bn.

The deficit was 2% of GDP last year - the lowest rate since 2002.

When George Osborne took over as Chancellor in 2010, borrowing stood at 9.9% of GDP.

Several years of austerity helped cut that figure and a policy of restricted spending has continued under Mr Hammond.

"The public finances were boosted in April by strong income tax receipts, which was helped by the strong rise in employment over the early months of 2018," noted Howard Archer, chief economic adviser to the EY Item Club.

How much money the Chancellor will have to play with will depend on how the economy performs this year.

The year got off to a disappointing start when bad weather restricted growth to just 0.1% in the first quarter.

However, Mr Carney has reiterated his view that the slowdown is temporary: "Our view is not that circumstances changed in the first quarter. It's more likely to have been temporary and idiosyncratic factors that slowed the economy."

Analysis: Kamal Ahmed, BBC economics editor

With public sector net borrowing now £4.7bn below the Office for Budget Responsibility's official forecast - record levels of employment are keeping tax receipts healthy - a little bit of "wriggle room" has certainly opened up in the public finances.

If the trend continues, the government could announce more spending in the autumn Budget and still be on course to hit its own target of balancing borrowing and spending by the middle of the next decade.

Of course there are many - including in the Labour Party - who say the Conservative focus on "balancing the books" and eliminating the deficit is the wrong approach and the government should borrow more to invest.

Philip Hammond, a fiscal conservative, sees a different challenge.

As the deficit falls, colleagues could become bolder in their spending requests.

And the balance between keeping "control" of the public finances and loosening the spending reins may tip towards the latter.

The government has already made it clear the NHS is set for a major Budget boost.

Details of that are expected imminently.

If the economy does bounce back from its stupor in the first three months, as the Bank of England expects, then the chancellor could be rather more generous on spending by the end of the year than he may originally have expected.

Correction 5 July 2018: This article has been amended following a complaint to the BBC's Editorial Complaints Unit.

- Published10 May 2018

- Published2 August 2018