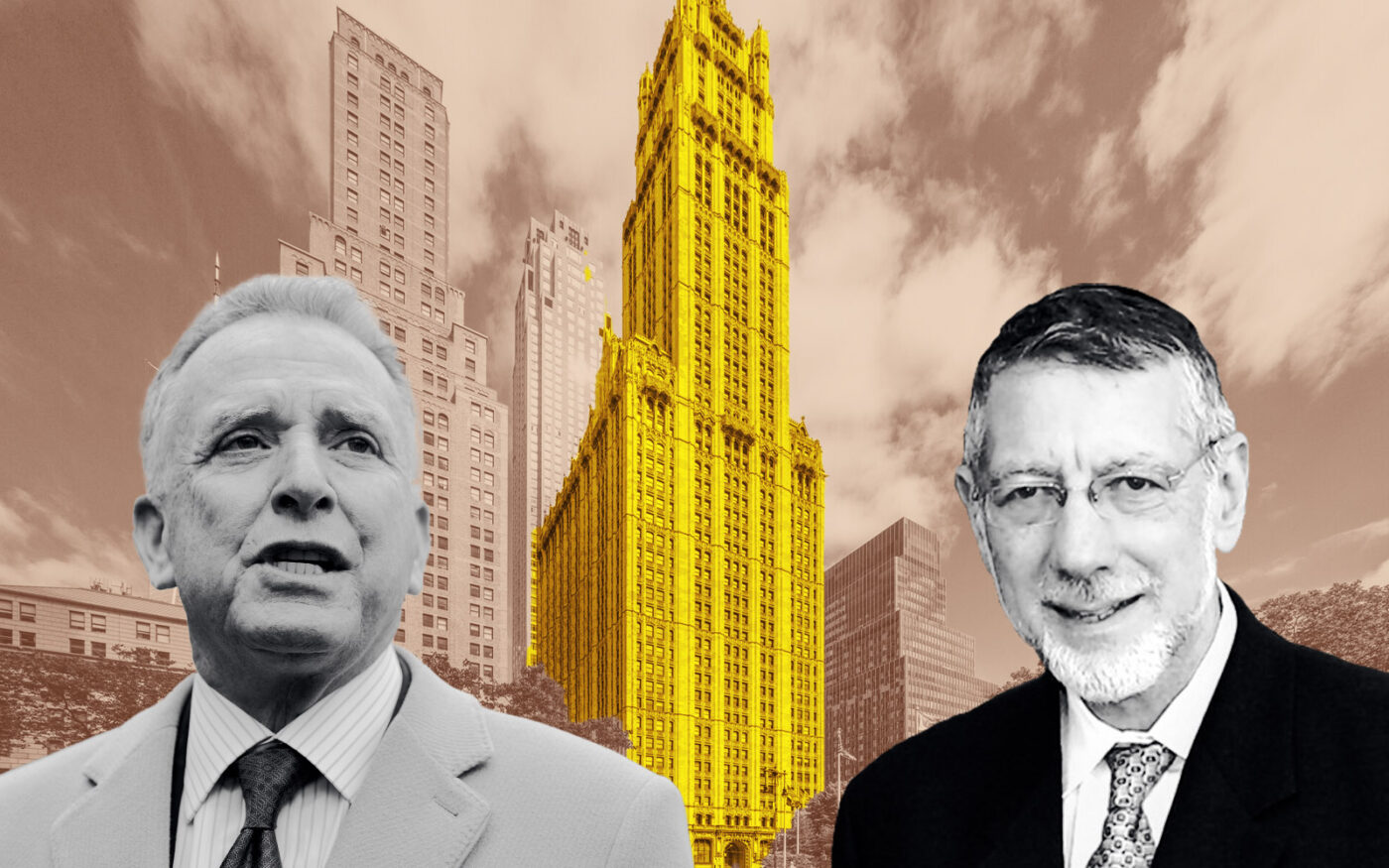

The Witkoff Group and Cammeby’s International Group refinanced the office portion of the famed Woolworth Building in Lower Manhattan.

Blackstone Group provided a $278.9 million loan at 233 Broadway, PincusCo reported. The loan breaks down to $358 per square foot.

The transaction closed earlier this month. The debt replaced a previous $256 million issued in 2015, also by Blackstone. Iron Hound Management represented Cammeby and Witkoff in the deal.

None of the parties involved immediately responded to a request for comment from The Real Deal. The entire debt of the property is $301.6 million, according to Traded.

Steve Witkoff and Ruby Schron purchased the entirety of the Woolworth Building in 1998 for $137.5 million. In 2012, an investment group led by Alchemy Properties purchased the top 30 floors of the 60-story building for $68 million and proceeded to create luxury condos, which were not involved in the refinancing.

A portion of the office condo’s debt was included in a CMBS deal in the fall of 2020, providing a peek at the building’s performance. As of July 2020, the office condo was 92 percent leased to 84 tenants, up from 79 percent leased in 2015. The largest tenant at the time was New York University, which utilized 94,000 square feet for its School of Professional Studies, as well as administrative offices.

Last month, tenants signed deals covering 1.25 million square feet in Downtown Manhattan alone, according to a Colliers report, representing the district’s highest monthly leasing volume since December 2019.

“Downtown leasing has sort of been the exception to the uptick we’ve seen in demand over the last several quarters,” said Colliers’ Franklin Wallach, one of the authors of the report.

A Blackstone-led venture is in the midst of trying to sell commercial debt once held by Signature Bank, at least its third attempt to sell loans from the stake. The joint venture of Blackstone, Rialto Capital and the Canada Pension Plan Investment Board is marketing $395 million worth of commercial property loans in the tri-state area.

The story has been updated to reflect Iron Hound Management’s representation in the deal.

Read more