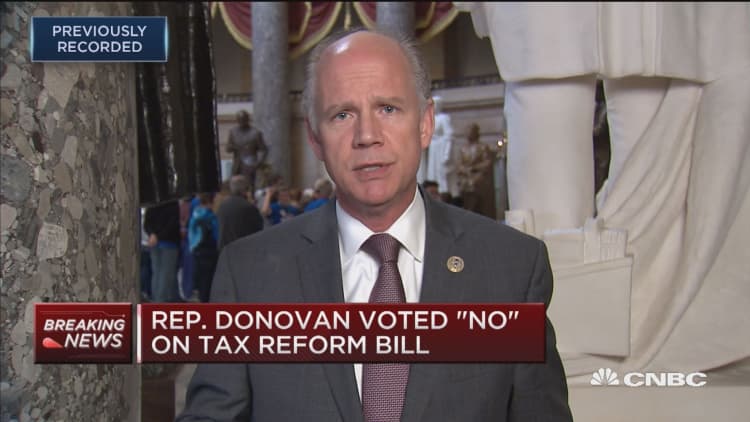

Republican Rep. Dan Donovan told CNBC on Thursday he voted "no" on his party's tax reform bill because it is "unfair" to the state he represents: New York.

The House bill changes the provisions that allow people to deduct state and local taxes but leaves a deduction on up to $10,000 in property taxes in place. The current Senate bill, meanwhile, completely eliminates all state and local tax deductions.

New York, along with California and New Jersey, is a high-tax state that can be hurt by the scrapping of the popular provisions.

"I am in favor of reforming our tax code. It's over-burdensome, it's complex, it's unfair. But the one thing that we have to do is make sure that all Americans receive a tax cut," Donovan said in an interview with "Power Lunch."

The House passed its legislation on Thursday with 227 votes in favor and 205 against, including 13 Republicans. The Senate Finance Committee is expected to vote Friday on whether to advance its measure to the full chamber.

New Yorkers "deserve the same break that the rest of America is going to get and not pay for the tax cut that the rest of the nation is going to see," Donovan said.

In fact, he said, New York is a "donor state," because for every $1 it sends to Washington it gets less than 80 cents back.

"When people talk about this deduction being a subsidy for New York, no one is subsidizing New York. New York is subsidizing the rest of the nation," he said.

Donovan said he believes there is a compromise, which he has proposed along with Rep. Peter King and Rep. Lee Zeldin. It would keep the deductions in place for four years. After four years, families making $400,000 and less would be able to keep the deductions and those making over that amount would lose it, he said.

"No one would get hurt with that," he said. "It would protect the middle class in New York and at the same time let the rest of the country get the tax cuts that they deserve as well."

— CNBC's Jacob Pramuk contributed to this report.